The sun starts to set on Wild West days of crypto

Even as cryptocurrencies have become more widely accepted as an asset class, they have struggled to throw off their reputation of inhabiting a digital “Wild West” — a place where law and regulation rarely apply.

There are signs, though, that the lawless days of cryptocurrencies are coming to an end. And, as a result, companies marketing crypto assets — as well as digital services providers — are scrambling to avoid being taken to task by new regulatory requirements.

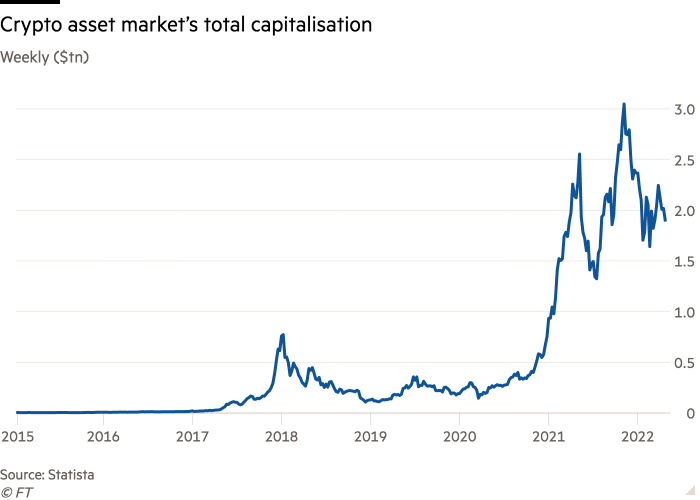

Cryptocurrency markets have grown fast since the beginning of the coronavirus pandemic, and the industry’s value has regularly exceeded $2tn, according to financial authorities.

Last month Fabio Panetta, executive board member of the European Central Bank, told a US audience that the market for crypto is now larger than that for subprime mortgages was — $1.3tn — when it triggered the global financial crisis in 2008.

He said an estimated 16 per cent of Americans and 10 per cent of Europeans were exposed in some way to cryptocurrencies or related assets — and warned of the potential dangers of a market crash.

Today, the ECB is one of many regulators worldwide looking at ways of reining in this previously unsupervised space, where a lack of rules has been at once a key attraction and a source of concern.

This has led increasing numbers of crypto companies to ask for help in adhering to the growing regulatory demands, says Rachel Woolley of Fenergo, a Dublin-based compliance software company.

“Many virtual asset services companies have been backfilling their compliance obligations as they haven’t been doing them as effectively as they could have done,” says Woolley, Fenergo’s global director of financial crime.

“This idea that you can deliberately violate obligations has to go. The reality is that regulation [in crypto] will get tighter and there will be fines,” she adds.

Fines and bans are already being imposed.

As a basic requirement, regulators want trading platforms and service providers to carry out anti-money laundering checks — a rule that keeps tripping up many.

In April, the US Office for the Comptroller of the Currency issued a cease-and-desist order against Anchorage Digital Bank, which had claimed to be the first federally chartered digital asset bank able to act as custodians and offer crypto to their customers. But, last month, the licensing watchdog withdrew authorisation, citing a lack of controls in monitoring for suspicious activity — including anti-money laundering checks.

The ban is in line with research findings from Fenergo showing a rise in the targeting of cryptocurrency-related businesses by regulators.

In August last year, trading venue BitMex was forced to pay $100mn to the US Commodity and Futures Trading Association in fines because of its failure on anti-money laundering checks.

Many crypto companies argue that most players in the industry are keen to follow rules but that lack of clarity about what is required is hindering this effort.

UK regulators have been criticised for slow progress both in registering companies that want to offer digital asset services and in establishing a framework for crypto.

Nikhil Rathi, chief executive of the UK’s Financial Conduct Authority, said last month that the regulator is waiting for more powers to supervise crypto companies beyond basic anti-money laundering requirements.

He also said the FCA has deemed just 33 companies fit to operate so far. “Many were rejected as they had inadequate provision to prevent harm, or even identify it in the first place,” he said. “We need to draw clear lines . . . as we have consistently warned, if you invest in crypto, you need to be prepared to lose all your money.”

Legal disputes over digital assets can present new challenges, too. Sergey Romanovsky, the chief executive and founder of Nebeus, a Barcelona-headquartered company that lends out cash against crypto, has found this out the hard way.

His business nearly collapsed under the strain of a court case that alleged that the company did not safeguard a client’s money properly. The case ended with a ruling in Nebeus’s favour, but Romanovsky was badly affected by a court decision to temporarily freeze the company’s assets, because of a technical misunderstanding.

He argued in a UK court for keeping the $1.5mn in question in so-called “cold storage” — on a device similar to a USB stick that keeps digital assets secure by holding them offline. The court initially deemed this unacceptable, leading to the freezing order.

“In hindsight, there were simple steps Nebeus should have taken: namely, holding the suspected fraudulent crypto assets in a format that the court would better understand,” Romanovsky says.

Fenergo’s Woolley cautions that companies can also fall prey to unexpected regulatory turnrounds. She says the case against Anchorage is a cause for concern because it makes regulators look like they are flip-flopping.

“I’m concerned about regulators granting Anchorage’s licence in January last year and, less than 18 months later, they’re going back on it — the question is why did they give them a licence without those systems in place in the first place?” Woolley asks. “Those checks should have been there from day one.”

But as well as protecting against the dangers of money laundering, regulators are now focusing on consumer protection in crypto transactions. In addition to the UK’s FCA, a group of European financial supervisors concurred in late March that many crypto assets are highly risky and speculative, and subject to “aggressive promotion.”

Many in the crypto industry expect that new regulations will vary from country to country, potentially allowing companies to move to jurisdictions where the rules are more favourable to them.

Ian Mason, head of UK financial services regulation at the law firm Gowling WLG, says that this potential for regulatory arbitrage is a worry due to the global nature of crypto.

“There is a need for regulation to be more joined-up, so that there are consistent, high standards across the crypto markets,” Mason says.

Digital asset market hits new fragile highs

The rapid rise in the total value of all crypto assets demonstrates a growing appetite among consumers to hold them as an alternative to traditional currencies and other stores of value, reports Michael Kavanagh.

But huge recent swings in market capitisation of the asset class have again shown the dangers of assuming crypto is a one-way bet.

Since 2017, the market has been marked by huge spikes and falls in total value, reflecting huge volatility in the trading value of bitcoin and rival currencies.

Market value tipped above $3tn last November before crashing close to $1.6tn in February and has still to recover ground.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Hedera

Hedera  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Monero

Monero  Ethena USDe

Ethena USDe  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Aptos

Aptos  Dai

Dai  Bittensor

Bittensor  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  OKB

OKB  sUSDS

sUSDS  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Gate

Gate  Internet Computer

Internet Computer  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic

Comments are closed.