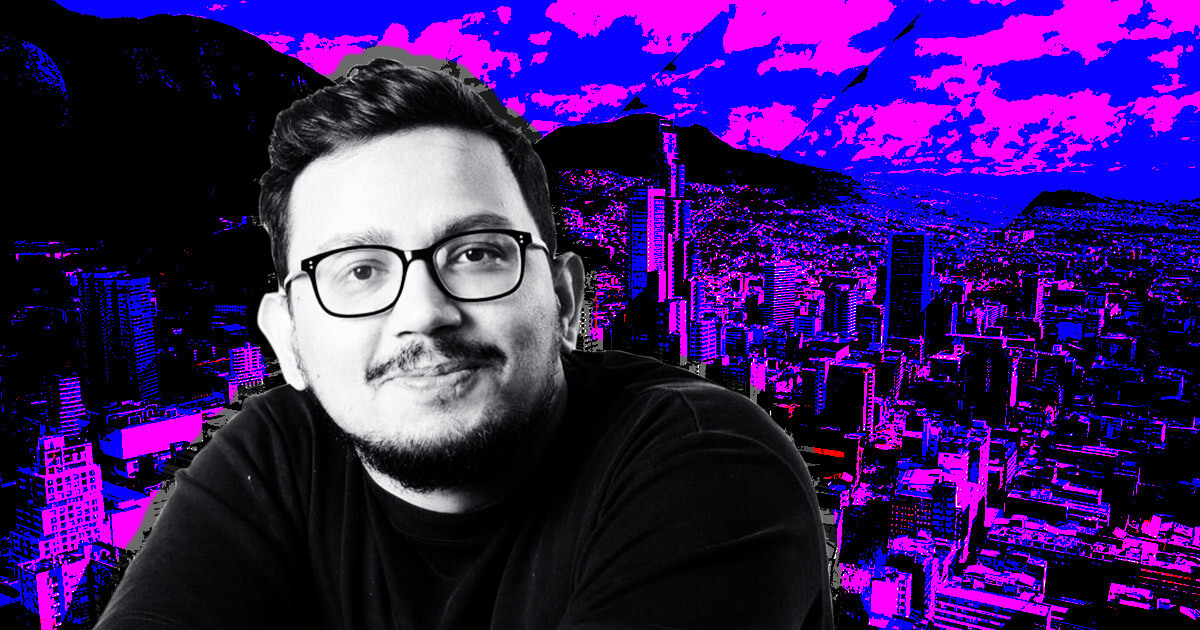

Polygon’s Sandeep Nailwal warns memecoin rug pulls like QUANT may invite regulatory crackdown

Sandeep Nailwal, the Ethereum layer-2 network Polygon co-founder, has voiced concerns that the growing trend of memecoin scams could attract regulatory scrutiny.

Nailwal highlighted these risks in a Nov. 21 post on X, pointing to recent incidents as potential triggers for government intervention in the crypto space.

QUANT controversy

Nailwal’s remarks were prompted by a scandal involving Gen Z Quant (QUANT), a memecoin launched on the Solana-based platform Pump.fun.

On Nov. 20, blockchain analysis platform Lookonchain reported that a 13-year-old created the token during a live stream event. The memecoin’s value surged over 260% within minutes before crashing when the boy sold all his holdings, profiting $30,000.

The teenager’s actions didn’t stop there. Shortly after the QUANT rug pull, he deployed two more tokens—LUCY and SORRY—and repeated the scam, earning an additional $24,000. These incidents fueled outrage, with affected traders accusing the boy of abusing Pump.fun for personal gain.

The backlash escalated when the boy taunted investors online. Some enraged traders retaliated by pumping the price after he sold, doxxing his family, and revealing personal details such as addresses and social media profiles. This led to further chaos, as new tokens themed around his family members began appearing on Pump.fun, turning the situation darker.

Market implications

Industry leaders like Nailwal warned that such incidents tarnish the crypto industry’s image and could prompt stricter regulations. He noted that the lack of oversight in the memecoin sector fuels speculative mania and exposes investors to significant risks.

Nailwal stated:

“Things like this might invite regulatory intervention on the memecoin mania. That will lead to tectonic shift in the current industry narrative. This paints a terrible picture for crypto amongst the masses.”

The ongoing crypto market rally has fueled a wave of memecoin launches, often tied to trending topics or individuals. Many of these tokens lack utility or substantial community backing and are prone to pump-and-dump schemes. Investors who enter these markets late often suffer significant losses.

Mentioned in this article

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  USDS

USDS  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  Litecoin

Litecoin  Sui

Sui  LEO Token

LEO Token  Shiba Inu

Shiba Inu  MANTRA

MANTRA  Hedera

Hedera  WETH

WETH  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Aptos

Aptos  sUSDS

sUSDS  Bittensor

Bittensor  Aave

Aave  Ondo

Ondo  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  Mantle

Mantle  Official Trump

Official Trump  Coinbase Wrapped BTC

Coinbase Wrapped BTC

Comments are closed.