Michael Saylor: “Europe Will Need Bitcoin”—Here’s Why

- Michael Saylor stated on X that “EUR gonna need BTC,” implying Bitcoin’s role as a hedge against economic uncertainty for the Euro.

- Saylor’s company, Strategy, is aggressively accumulating Bitcoin, evidenced by recent purchases and the launch of a new investment vehicle, Strife

Michael Saylor, executive chairman at Strategy (formerly MicroStrategy), has once again stirred controversy in finance with a bold prediction. In a statement on his social media account on X, he proclaimed:

EUR gonna need BTC.

The announcement was a warning sign that implied that Bitcoin would be used as a hedge against uncertainty in the economy. Some users agreed with Saylor’s assertion, while others demanded more context and wondered if the euro was truly in a vulnerable position.

Saylor has long been a proponent of Bitcoin and always positioned it as a hedge against the devaluation and inflation of fiat currency. All his statements are in line with his ongoing stance that Bitcoin is not just a digital currency but something that you must have in uncertain times.

A Strategic Push for Bitcoin Reserves?

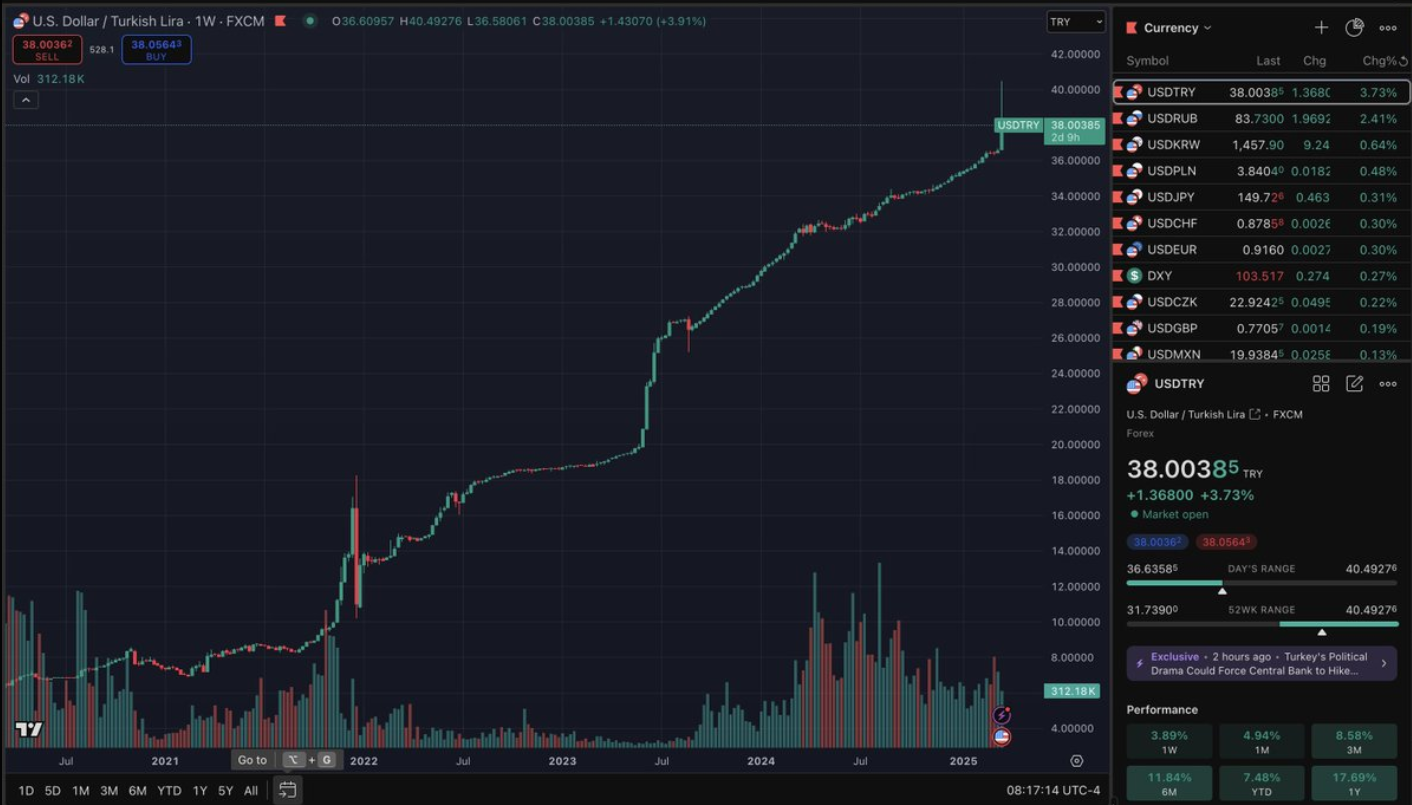

On 19th March, Saylor tweeted a chart showing the dramatic rise of the US dollar against the Turkish lira with a second taunting tweet: “Try BTC.” It can be interpreted as a subtle nod to national Bitcoin reserves such as those already possessed by the United States.

The U.S. now has over 199,000 BTC valued at nearly $17 billion that were seized from criminal enterprises like the infamous Silk Road marketplace. The government has not yet announced significant Bitcoin purchases but current reserves indicate a de facto acknowledgment of BTC’s growing prominence.

This idea of a Strategic Bitcoin Reserve (SBR) has been controversial ever since former President Donald Trump signed an executive order to explore such possibilities. Although government adoption is possible, no outright purchases of BTC have been contemplated in the near term.

Strategy’s Relentless Bitcoin Accumulation

Saylor’s own company, Strategy, remains one of the biggest corporate holders of Bitcoin. The firm currently owns 499,096 BTC, acquired over nearly four years. Earlier this week, the company boosted its holdings again with the purchase of 130 additional BTC.

Not stopping there, Strategy recently launched Strife (STRF), a new investment vehicle designed to fuel further Bitcoin accumulation. Through this offering, the company aims to issue 5 million Series A Perpetual Strife Preferred Stock, offering a 10% annual dividend to investors. This move is part of Strategy’s long-term plan to secure $21 billion worth of BTC over the coming years.

Under Saylor’s leadership, Strategy has transformed from a software company into the largest corporate Bitcoin investor. In recent years, it has also become the top issuer of convertible bonds, raising around $9 billion—most of which has gone directly into Bitcoin.

Beyond finance, Saylor has also introduced intriguing metaphors to describe Bitcoin’s position in the global economy. In a March 15 post, he likened BTC to an “Orange Dwarf”, saying:

Bitcoin is an Orange Dwarf—the brightest object in the financial system—growing stronger, hotter, and denser as it attracts capital.

Recommended for you:

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Chainlink

Chainlink  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  USDS

USDS  Shiba Inu

Shiba Inu  Sui

Sui  Wrapped stETH

Wrapped stETH  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  WETH

WETH  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Dai

Dai  Uniswap

Uniswap  OKB

OKB  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Aptos

Aptos  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Mantle

Mantle  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic