Coinbase Endorses XRP for Financial Institutions Due to ODL Capabilities

- America’s biggest crypto trading firm, Coinbase, is all out for XRP, spotlighting its ODL strength.

- The adoption of XRP is growing across the board, a shift that may translate to price gains.

The biggest US crypto exchange, Coinbase, has endorsed the Ripple-linked XRP for financial institutions. According to Coinbase, XRP’s On-Demand Liquidity (ODL) capabilities make the coin appealing to payment providers and financial institutions.

Coinbase Plans to List XRP Futures

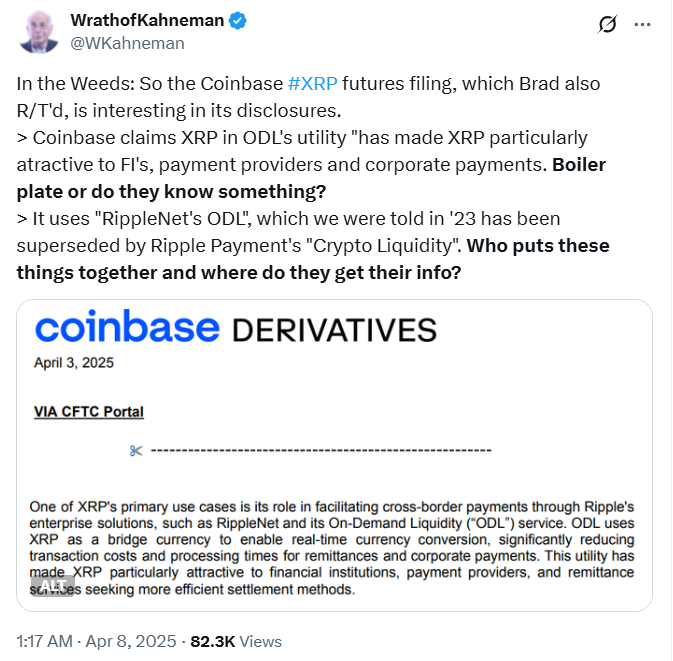

XRP community figure WrathOfKahneman on X brought the market’s attention to Coinbase’s endorsement of XRP. He disclosed the endorsement while highlighting specific details in Coinbase’s filing with the US CFTC to self-certify its listing of XRP futures contracts.

Coinbase submitted the XRP futures filing on April 3, 2025, declaring its listing plans on its derivatives trading platform later this month. The XRP community praised the filing as a move that could clear the path for the potential launch of XRP ETFs.

Amid community members’ discussion of Coinbase’s self-certified XRP futures contracts, WrathOfKahneman shared some details about the filing disclosure. The exchange acknowledged that XRP’s primary use cases center around its ability to facilitate cross-border settlements through RippleNet and ODL.

The exchange describes ODL as a service that leverages XRP to facilitate real-time currency conversion. Coinbase noted that XRP is attractive to financial institutions because of its ODL utility. Remittance services and payment providers seeking more efficient settlement methods also find XRP attractive due to its ODL capabilities.

However, WrathOfKahneman questioned whether Coinbase’s description of XRP’s utility is merely a cliche or if the exchange had insider insights. He further noted that Coinbase mentioned RippleNet’s ODL.

This is despite Ripple disclosing in 2023 that its Crypto Liquidity solution had superseded the service. WrathOfKaheman, therefore, questioned the exchange’s source of information due to its use of outdated details.

For now, the CFTC is reviewing Coinbase’s request to self-certify the listing of its XRP futures contracts. Once the regulator approves the filing, the product will launch on Coinbase’s Derivatives platform on April 21.

Meanwhile, Bitnomial has launched the first CFTC-regulated XRP futures product in the US with a physical settlement. As we covered in our latest report, this launch indicates that XRP is gaining a new foothold in the derivatives space.

XRP Becoming an Appealing Payment Option

Unsurprisingly, XRP is increasingly gaining ground as a payment option. As featured in our recent coverage, 80% of Japanese banks have already integrated XRP into their financial systems.

SBI Holdings, a supporter of Ripple’s ODL product, is at the forefront of this initiative. The bank employs the XRP cryptocurrency to facilitate instant and cost-effective international payments.

Banks could enhance their foreign exchange and cross-border payment processes by incorporating XRP into their operations. This can lead to improved efficiency and quicker customer service, reducing the waiting times for transactions that typically take several days.

Moreover, several major financial institutions are testing XRP for real-time payments, as discussed earlier. Analyst Amelie also recently confirmed Ripple’s growing partnership with banks, sharing a post from Ripple’s CEO Brad Garlinghouse.

Recommended for you:

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Sui

Sui  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  WETH

WETH  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Uniswap

Uniswap  OKB

OKB  Pepe

Pepe  Aptos

Aptos  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Mantle

Mantle  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Cronos

Cronos