Best Cryptocurrencies to Invest in Right Now September 15 – Bittensor, Stacks, Sui

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin recently saw a 15.31% rebound, pushing its price back into the $60,000 range. This movement has shifted the market’s Greed and Fear Index from extreme fear to a more neutral position. This change in sentiment suggests that traders are becoming more confident, moving away from panic-driven decisions. As the market shows signs of stabilization, investors are increasingly exploring the best cryptocurrencies to invest in right now, seeking to capitalize on potential opportunities.

Best Cryptocurrencies to Invest in Right Now

This week, Bittensor saw a notable 31% rise in value, positioning it as one of the leading performers among the top 100 cryptocurrencies. Additionally, Stacks has introduced the Stacks Asia Foundation, aiming to grow its ecosystem within the Asian market. Meanwhile, the Sui platform has entered a partnership with 3DOS, a company focused on manufacturing.

1. Bittensor (TAO)

Bittensor experienced a significant surge this week, registering a 31% increase in value, making it a top gainer among the top 100 cryptocurrencies. This recent rise can be attributed to the positive movement in Nvidia Corp’s stock, which jumped 13.5% and closed at $119.08 on September 13, 2023.

According to MarketWatch, Nvidia’s market capitalization now sits at $2.92 trillion. The upward trajectory of Nvidia stocks, up 140.5% this year, has influenced the broader AI-focused cryptocurrency market. As Nvidia’s market performance improves, AI-related tokens, including TAO, have benefited from this momentum.

According to CoinGecko, the AI-crypto market cap has risen by 0.8% in the past 24 hours to $23.9 billion. At press time, Bittensor ranks 34th by market cap, valued at over $2.3 billion. Over the last 24 hours, its price has increased by 3.24%, with TAO trading at $323.88.

Furthermore, market sentiment around Bittensor remains bullish, with the Fear & Greed Index showing a neutral reading of 51. Technically, TAO trades above its 200-day simple moving average, which signals a longer-term positive trend.

The coin has also demonstrated strong liquidity for its market size, with 18 green trading days out of the past 30. This suggests consistent market interest and stable trading activity.

2. Stacks (STX)

Stacks aims to enhance decentralized applications (dApps) and smart contract capabilities. Recently, the project launched the Stacks Asia Foundation, an initiative focused on expanding its ecosystem in the Asian market. This foundation has raised $15 million from private investors, which will help support its mission of fostering growth in the region.

The platform is seeing increased activity, highlighted by more than 1,400 monthly smart contract interactions. This uptick signals growing interest in building dApps on Bitcoin, which has traditionally lagged behind other networks in this area. The timing of this growth is crucial, as Stacks is nearing the completion of its Nakamoto upgrade.

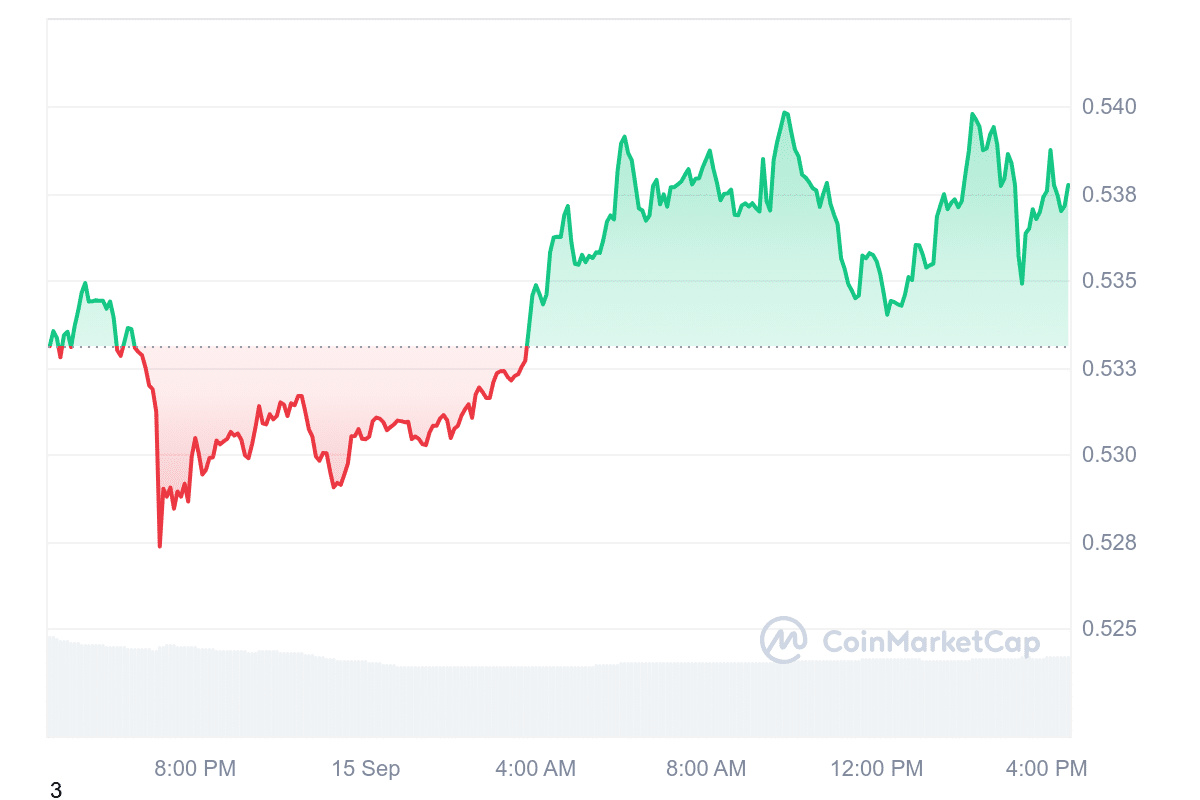

This upgrade will improve transaction speeds and reduce settlement times, further enhancing the platform’s appeal. As of the latest data, STX is trading at $1.60, reflecting a minor intraday decline of 0.64%. Despite this short-term dip, STX has experienced notable growth recently, rising 14.18% over the past week and 11.62% in the last 30 days.

The Bitcoin L2 Stacks narrative is taking over Southeast Asia 🧡🌏

Join the Stacks ecosystem in painting the world orange at:

🟧 Sep 17, Singapore

🟧 Sep 20, Singapore

🟧 Nov 12, BangkokTogether with the recently announced @StacksAsiaOrg! Check out the events below 👇 1/3. pic.twitter.com/SHrWo4pO41

— stacks.btc (@Stacks) September 14, 2024

Furthermore, the token trades above its 200-day simple moving average, suggesting a strong performance relative to its longer-term trend. It has recorded 16 green days out of the last 30, a success rate of 53%. This trend further reflects stability within a fluctuating market.

Meanwhile, the Relative Strength Index (RSI) for STX currently sits at 37.18, placing it in neutral territory. This suggests that the token isn’t overbought or oversold, and the market may continue to trade sideways in the short term. This neutral positioning could help build positive market sentiment as traders seek clearer price signals.

3. Crypto All-Stars (STARS)

Crypto All-Stars is quickly gaining traction in the meme coin space, raising over $1.2 million. Its rapid growth is largely driven by the overall popularity of meme coins and the platform’s specific focus on staking as a utility.

The project seeks to unite meme coin communities under a single platform, allowing investors to engage with multiple projects while earning rewards through staking. Furthermore, the platform features “MemeVault,” enabling users to stake different popular meme coins, such as Pepe and Dogecoin, all in one place.

This aims to simplify the staking process, lower transaction fees, and improve overall efficiency. Additionally, the platform’s multi-chain functionality supports cross-chain transactions, giving users more flexibility when managing assets across different blockchains.

Crypto All-Stars has also garnered attention through targeted social media marketing, resulting in a growing follower base. Notably, 20% of the total token supply is set aside for marketing, indicating a significant promotional push following the token’s launch on decentralized exchanges.

To address concerns around initial coin offerings (ICOs), the project has committed 10% of its token supply to liquidity. This move is designed to reduce the risk of a rug pull and ensure smoother trading with low slippage upon the token’s release. STARS is emerging as a notable token within the meme coin space, aiming to provide investors with a unified platform for staking and user engagement.

Visit Crypto All-Stars Presale

4. Arbitrum (ARB)

Arbitrum recently announced its integration with Circle Internet Financial, the issuer behind USD Coin (USDC). This partnership introduces new capabilities for decentralized finance (DeFi) and broader Web3 development. As USDC competes for market share against other stablecoins, this integration underscores its expanding presence in the DeFi ecosystem.

The collaboration adds several useful features to Arbitrum’s network, such as programmable wallets, smart contract tools, and gas-fee abstraction. These innovations aim to simplify the development of decentralized applications (dApps) on the platform. They also improve the overall user experience by streamlining wallet access and reducing global payments, e-commerce, and gaming transaction complexities.

Meanwhile, Arbitrum has quickly established itself as a key player in the Ethereum ecosystem, with a total value locked (TVL) of around $2.5 billion, as reported by DefiLlama. Its appeal largely stems from its ability to offer faster and more cost-effective transactions than Ethereum’s main network, making it a go-to platform for developers in the DeFi space.

CoW AMM is now live on Arbitrum! 🐄

Built for MEV-capturing. Moo with @CoWSwap

Powered by @Balancer https://t.co/b5JX8Htu1s

— Arbitrum (💙,🧡) (@arbitrum) September 12, 2024

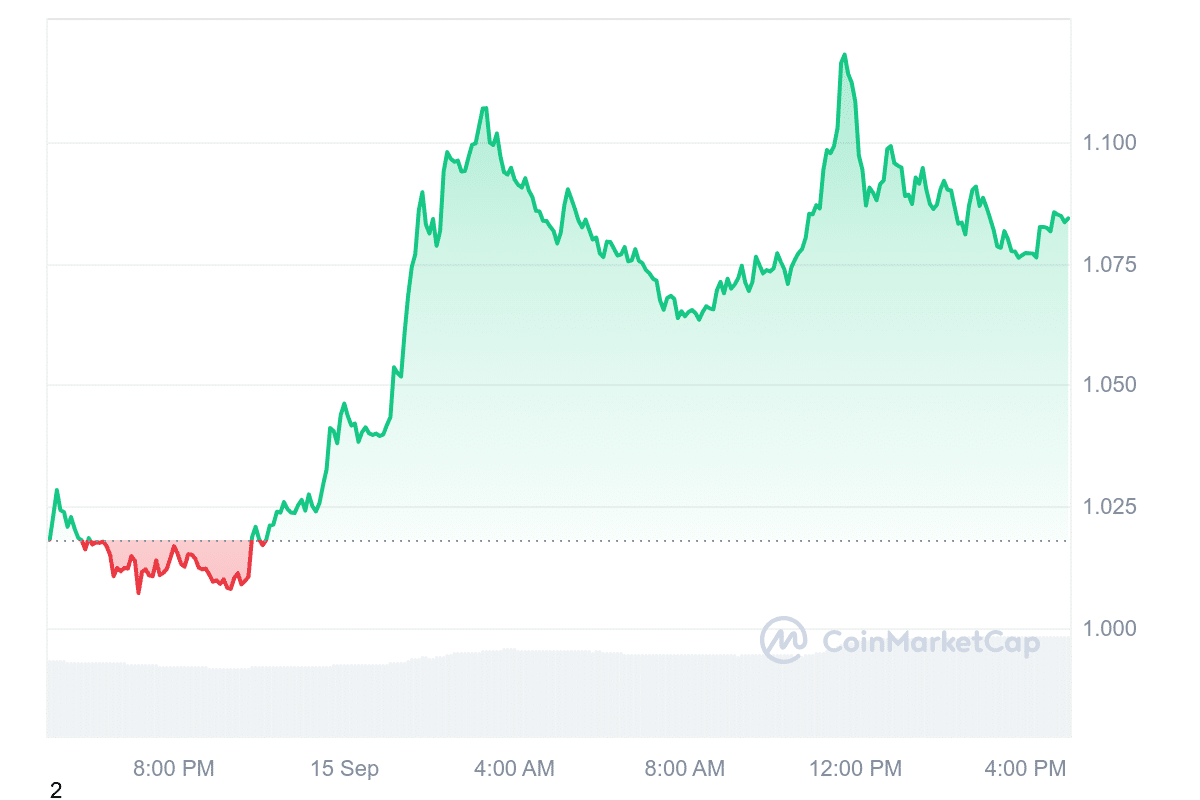

The platform’s native token, ARB, currently trades at $0.5378, experiencing a modest intraday rise of 0.88%. It has also seen positive market movement, with 16 out of the last 30 days in the green. Given its market capitalization, ARB also demonstrates high liquidity, placing it among the best cryptocurrencies to invest in right now.

5. Sui (SUI)

Sui has gained attention as a notable project in the cryptocurrency market. Analysts suggest potential profits for SUI holders in the coming months. The platform stands out by blending Web3 innovations with the familiar, user-friendly interface typical of Web2 systems.

This combination makes Sui accessible to a wider range of users while maintaining the advanced functionality expected in decentralized systems. The Sui platform recently collaborated with 3DOS, a company specializing in manufacturing. This partnership focuses on creating a global decentralized network that connects users, 3D printers, and manufacturers.

The goal is to coordinate 3D printing tasks across a network in real time, ensuring efficient use of production resources. Sui acts as the central layer that synchronizes these components, enabling seamless coordination between parties. Furthermore, this integration between Sui and 3DOS marks progress toward a concept known as “one-click manufacturing.”

We teamed up with @3DOSNetwork so that users, 3D printers, and manufacturers can build anything they can imagine.

3DOS decentralizes manufacturing – meaning anyone can send a product design to an idle manufacturer anywhere around the globe. 📝 → 🌐https://t.co/coUZWEauMj

— Sui (@SuiNetwork) September 14, 2024

Through this decentralized network, users can upload designs and have them produced anywhere in the world. By streamlining this process, Sui and 3DOS aim to make manufacturing more accessible and flexible.

Moreover, Sui’s intuitive design and ease of use have contributed to positive market sentiment around the project. Many believe that these factors, combined with the platform’s ability to integrate smoothly into various industries, could drive significant price growth by Q4 2024.

Read More

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards – pepeunchained.com

- $10+ Million Raised at ICO – Ends Soon

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Pepe

Pepe  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polkadot

Polkadot  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Uniswap

Uniswap  Cronos

Cronos  Stellar

Stellar  Internet Computer

Internet Computer  Bittensor

Bittensor  dogwifhat

dogwifhat  Ethereum Classic

Ethereum Classic  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  Stacks

Stacks  Hedera

Hedera  Bonk

Bonk  Monero

Monero  Render

Render  OKB

OKB  Filecoin

Filecoin  Aave

Aave

Comments are closed.