Best Crypto to Buy Now August 30 – Conflux, Ondo, Stacks

Join Our Telegram channel to stay up to date on breaking news coverage

Recent activity in the cryptocurrency market has caught the attention of investors, leading them to explore various options. While Bitcoin’s price has declined by 1.07% in the past 24 hours, settling at $58,000, some altcoins like Conflux, Ondo, and Stacks have shown resilience.

This stability in altcoin prices could suggest a shift in investor focus from Bitcoin to these altcoins, possibly because investors perceive greater potential for growth in these assets. As a result, many investors are actively searching for the best crypto to buy now, aiming to secure substantial gains in the market.

Best Crypto to Buy Now

The new Perpetual futures for Conflux offer traders a strong opportunity to leverage their positions, which could increase market activity. Meanwhile, Ondo has launched its tokenized note, USDY, on the Arbitrum Network. Additionally, Stacks has caught the crypto community’s attention with its Nakamoto upgrade, designed to boost transaction speeds and enhance integration with its base blockchain.

1. Conflux (CFX)

Coinbase has announced plans to expand its perpetual futures offerings by including Conflux and two other tokens. Perpetual futures for Conflux have introduced a powerful opportunity for traders to leverage their positions, ultimately driving potential growth in market activity. This move is expected to draw interest from traders looking to benefit from the price fluctuations of CFX.

Meanwhile, Conflux has shown recent positive momentum in the market, supported by significant partnerships and the introduction of new trading options. Following the news, CFX experienced notable gains, reaching an intra-day high of $0.1408. Moreover, CFX traded at $0.1403 at press time, marking a 4.28% increase.

Over the past 30 days, the token has seen positive price movement on 15 days, representing a 50% success rate. Additionally, Conflux demonstrates high liquidity relative to its market capitalization. The 14-day RSI for Conflux stands at 53.41, indicating that the token is in a neutral zone. This suggests the possibility of sideways trading in the short term, with the potential for future price surges depending on market conditions.

🚀 NFT in China, on #Conflux we build! 🌐🎉

Embrace sustainability, and paint a layer of green on the Earth’s canvas! Jinjiang Hotels has launched a new NFT on Conflux, themed around straw reuse and exploring the harmony between humans and nature. pic.twitter.com/3JuyFfFhbH

— Conflux Network Official (@Conflux_Network) August 27, 2024

Furthermore, Conflux Network, known as China’s only regulatory-compliant public blockchain, recently partnered with China Mobile, the country’s largest telecom provider with over one billion monthly users. This collaboration aims to revolutionize digital collections through China Mobile’s digital content division, Migu.

The partnership will introduce advanced digital collectibles, such as video ringback tones (RBTs), digital identities (DIDs), and blockchain communication hardware, all powered by Conflux’s TreeGraph public blockchain. The first initiative from this partnership will involve the launch of the world’s first public blockchain-based digital collectible video ringtone, marking a significant milestone for Conflux and China Mobile.

2. Popcat (SOL) (POPCAT)

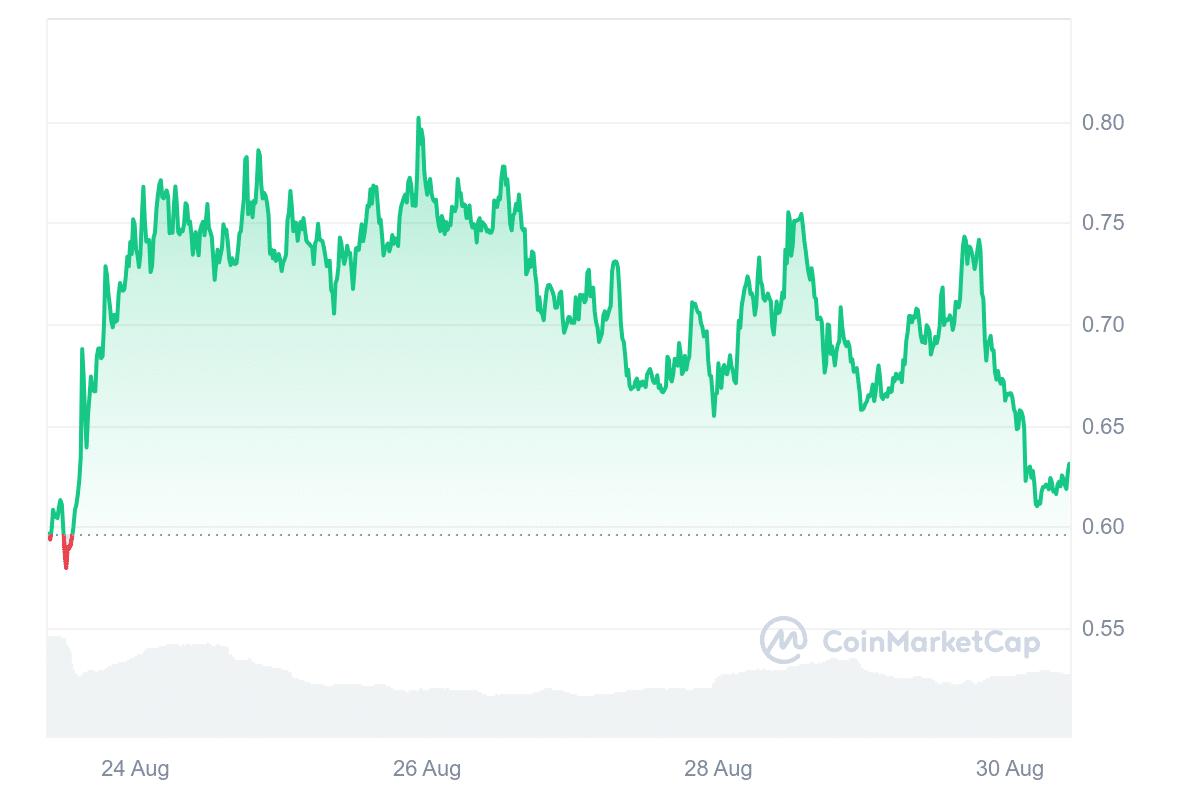

POPCAT has recently shown significant growth, with its value increasing by 5.00% over the past week. Furthermore, the token has offered long-term investors an annual return of approximately 3786%.

Growing buying pressure supports the upward momentum, and if the positive sentiment continues, POPCAT’s price could potentially reach $0.99730. Moreover, market sentiment for POPCAT remains optimistic, driven by several factors.

Meanwhile, Binance Futures recently introduced new USD-Margined perpetual contracts for POPCAT and SUN tokens. These contracts allow traders to leverage their positions up to 75 times their initial investment, offering enhanced trading opportunities and more diverse options.

Following this announcement, the price of the Solana-based meme token POPCAT saw a significant rally, with a 31% increase over 24 hours. This surge pushed the price to $0.5716.

Additionally, trading volume spiked by 119.07%, reaching $135 million. This surge in volume indicates heightened interest and activity in the token, making it the best crypto to buy now.

3. The Meme Games (MGMES)

In its presale phase, The Meme Games project has raised over $403,000, approaching its target of $1,118,526. Priced at $0.00935 per token, $MGMES presents itself as a potential candidate for the official cryptocurrency of the 2024 Paris Olympics.

Investors interested in MGMES can participate in the presale by purchasing tokens directly from the project’s website using an Ethereum or BNB Chain wallet. The total supply of MGMES tokens is capped at 2.024 billion, with 38% allocated for the presale. This allocation strategy ensures that early investors have access to a significant portion of the tokens before they become publicly available.

The #Paralympics have begun! 🌟

Join the $MGMES presale now and back your champion for a chance to win a 25% bonus! 🚀

Ready, set, go! 🏅👉https://t.co/6oUlx6ssLs pic.twitter.com/z3hurwVWkG

— The Meme Games (@MemeGames2024) August 29, 2024

Furthermore, The Meme Games offers a staking opportunity with an annual return rate of 476%. Staking allows investors to increase their holdings before the MGMES token begins trading on exchanges on September 10.

The presale is scheduled to end on September 8, coinciding with the closing ceremony of the ongoing Paralympics. This could lead to a potential increase in the token’s value once listed on the open market, giving investors a confident outlook.

Visit The Meme Games Presale

4. Ondo (ONDO)

Ondo has officially introduced its tokenized note, USDY, on the Arbitrum Network, marking a significant step forward for decentralized finance. This launch presents new opportunities for DeFi users, offering a secure, yield-bearing asset backed by short-term U.S. Treasuries.

By leveraging the Arbitrum network, USDY allows users to invest in real-world assets through top DeFi protocols like Camelot and Dolomite. Furthermore, USDY is designed to provide an annual percentage return of up to 5.35% on stablecoins, such as USD Coin (USDC), making it an attractive option for those looking to earn passive income within the DeFi sector.

According to Katie Wheeler, Ondo’s vice president of partnerships, this launch enables some of the largest DeFi applications to integrate tokenized U.S. Treasuries into their platforms, further enhancing the utility of USDY. Currently, USDY has a TVL of $364 million and is available on eight blockchain networks, including Ethereum and Solana.

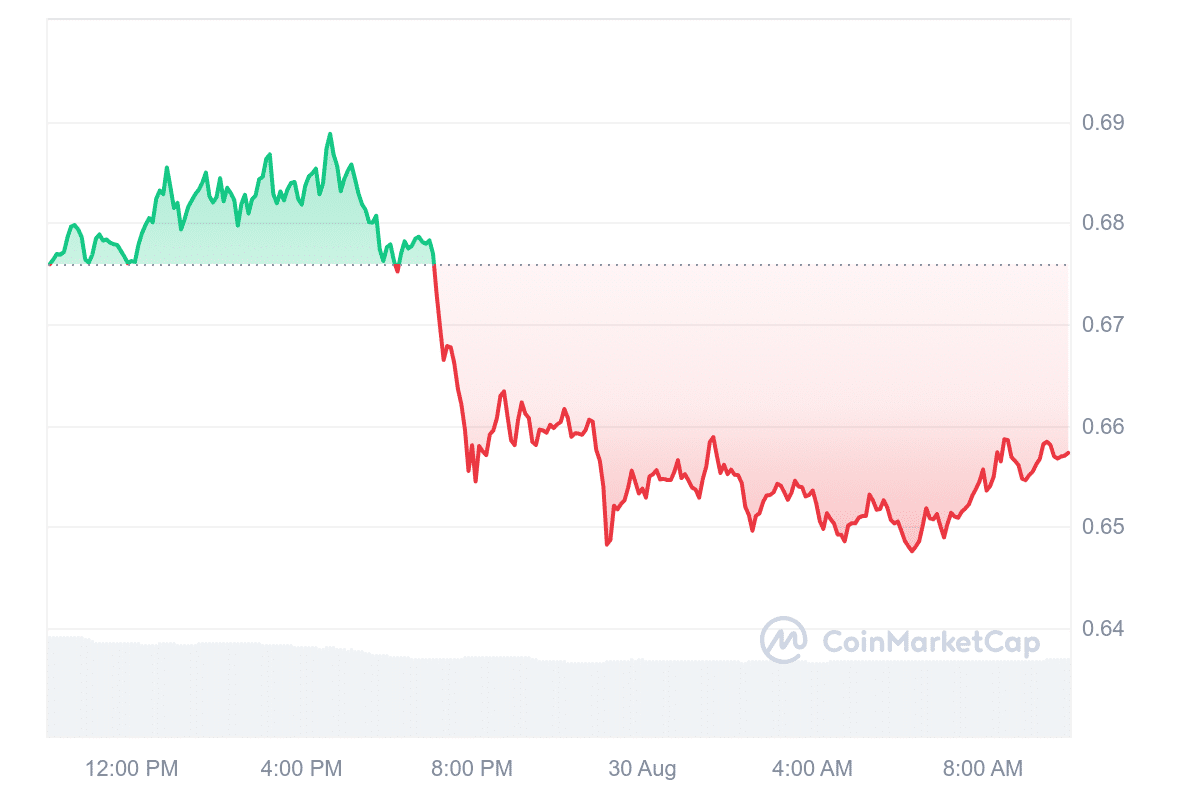

Ondo offers another similar product, the Ondo Short-Term U.S. Government Treasuries (OUSD). Regarding its native token, ONDO, the current trading price is $0.6568, with a slight intraday decrease of 2.82%.

However, the token has seen a year-to-date increase of 306%, indicating strong long-term performance. The token also benefits from high liquidity, supported by its market cap. According to CoinCodex, the price of ONDO is predicted to rise by 227.93%, potentially reaching $2.15 by September.

5. Stacks (STX)

Stacks has recently gained attention within the crypto community due to its Nakamoto upgrade, which aims to significantly boost transaction speeds and improve integration with its base blockchain. The Nakamoto Activation Sequence began on August 28, introducing several key enhancements to the Stacks protocol.

These improvements include faster transaction processing, stronger guarantees for transaction finality, and better protection against blockchain reorganizations. Additionally, the upgrade reduces opportunities for Bitcoin Miner Extractable Value (MEV), a concept where miners can exploit transaction ordering for profit.

Furthermore, these changes collectively bolster the network’s resilience and performance, providing reassurance about the capabilities of the Stacks. Meanwhile, Stacks emphasizes that this upgrade reinforces its position as a leading layer-2 solution for Bitcoin.

Nakamoto Activation Window Begins 🟧

Today marks the beginning of a sequence to safely bring the Nakamoto upgrade and its fast blocks and Bitcoin finality to the Stacks layer!

Celebrate with 21 days of events, big news, collaborations, giveaways, and more. 🧡

More 🧵 1/4 pic.twitter.com/tTwJ9Glxv5

— stacks.btc (@Stacks) August 28, 2024

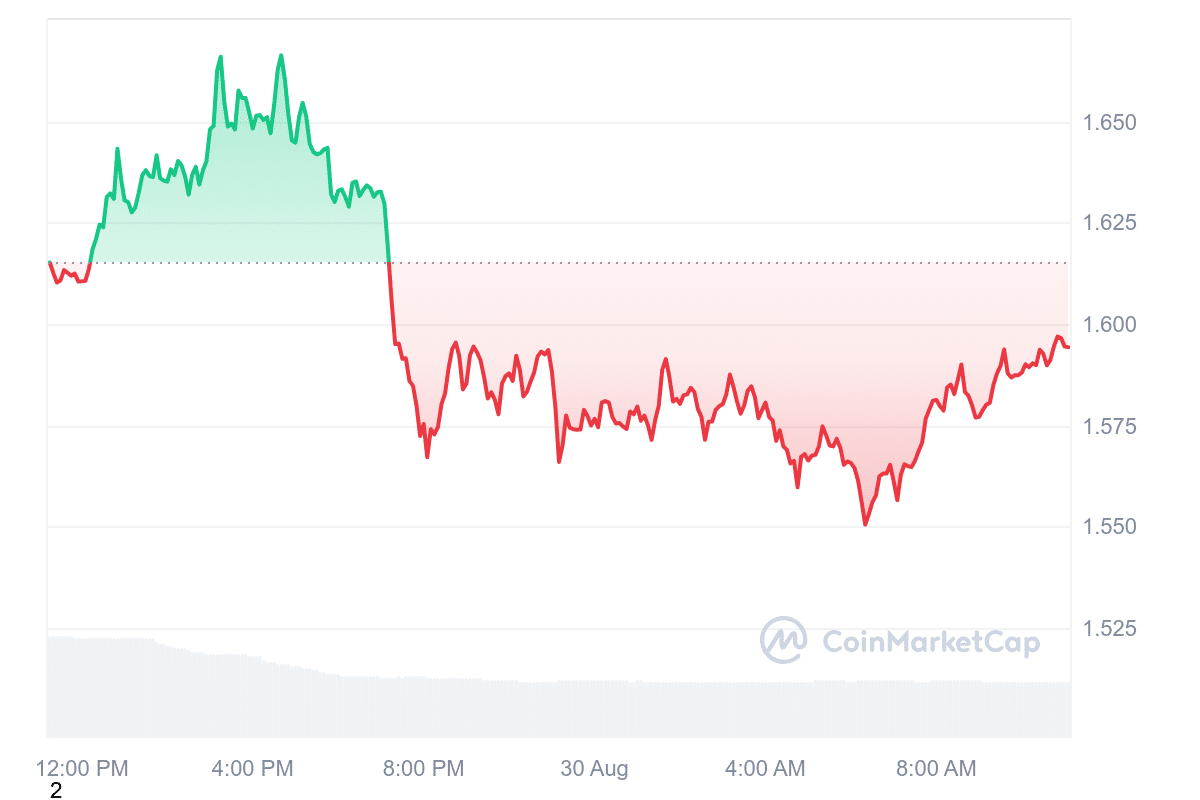

By facilitating more advanced smart contracts and dApps, Stacks continues to leverage Bitcoin’s security while expanding its utility. Despite this upgrade, STX has experienced an intraday decline of 1.32%, alongside a significant 45.44% drop in trading volume.

However, the upgrade is expected to improve transaction speeds and the network’s resilience. Currently, STX is trading above its 200-day simple moving average, a sign of stability in the longer term. With high liquidity relative to its market cap, the token remains attractive to traders.

The 14-day Relative Strength Index (RSI) for STX is 37.18, indicating a neutral market sentiment. This suggests that the token may continue to trade sideways, preparing traders for potential market movements.

Read More

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards – pepeunchained.com

- $10+ Million Raised at ICO – Ends Soon

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  Hedera

Hedera  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Celestia

Celestia  Filecoin

Filecoin  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Stacks

Stacks  Bonk

Bonk  OKB

OKB  Cosmos Hub

Cosmos Hub

Comments are closed.