AAVE Price Soars 7% As Whale Buys $264K Of This PEPE Spinoff

Join Our Telegram channel to stay up to date on breaking news coverage

The Aave price soared 7% in the last 24 hours to trade at $353.80 as of 2:20 a.m. EST on trading volume that jumped 30% to $2.6 billion.

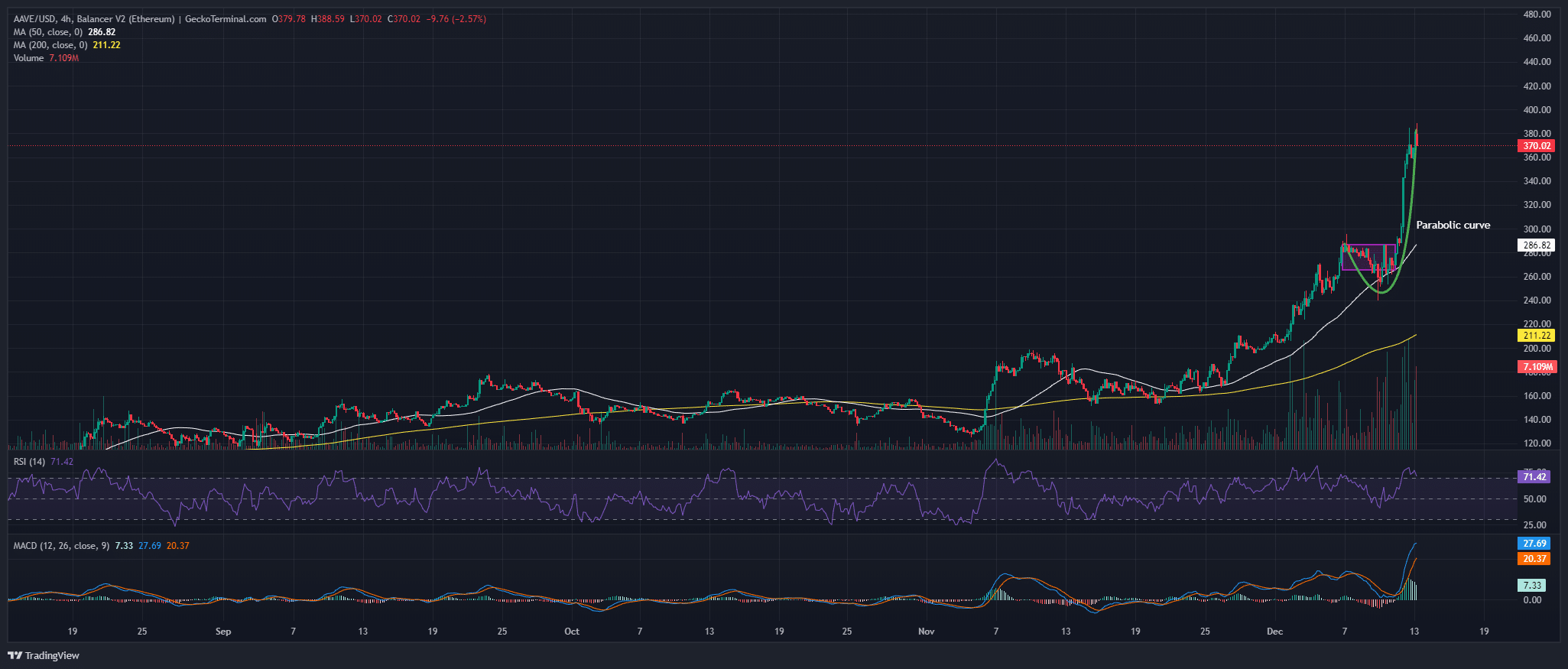

Aave Price Indicators Show A Continued Bullish Rally

The AAVE/USD 4-hour chart displays a clear parabolic curve. This pattern suggests strong bullish momentum.

The Aave price has surged dramatically to $370.02, representing a breakout from the consolidation phase that occurred near the $250-$300 zone, according to GeckoTerminal data.

This parabolic move signifies aggressive buying interest and a potentially overheated market in the short term.

The price of AAVE has consistently remained above both the 50 Simple Moving Average (SMA) on the 4-hour chart at $286.82 and the 200 SMA at $211.22, indicating a sustained bullish trend.

Meanwhile, the Relative Strength Index (RSI) is at 71.42, indicating the asset is in overbought territory. While this suggests strong bullish momentum, it also raises caution about a potential short-term pullback or consolidation as buyers may take profits.

The Moving Average Convergence Divergence (MACD) reflects strong bullish momentum, with the MACD line (blue) significantly above the signal line (orange) and both in positive territory. This aligns with the parabolic price move, but the large gap between the lines could signal an overstretched rally that may soon consolidate.

If the parabolic momentum continues, AAVE could target the next psychological resistance at $400. Breaking this level could then lead to further gains, with $450 being a potential target based on the parabolic curve’s trajectory.

Given the overbought RSI and the parabolic nature of the move, a short-term pullback is highly likely. The first support level is near the $300–$310 zone, aligning with the breakout level of the parabolic curve pattern. A deeper correction could test the 50 SMA at $286.82, which would still keep the overall bullish structure intact.

As the Aave price surges, investors are also buying up a new Pepe alternative called Wall Street Pepe (WEPE), which Cryptonews, a popular crypto YouTube channel with over 13K subscribers, says could be the next massive degen play.

Wall Street Pepe Raises Over $13 Million In Blockbuster Presale – Best Crypto To Buy Now?

The Wall Street Pepe presale has soared past $13 million in funds raised in a little over one week and $9 million in the last 2 days as it shapes up to be one of the top ICOs of 2024. The project continues to attract investors, with the latest buy being a massive $264K purchase.

The token promises to level the playing field for small investors as it draws inspiration from the legendary Pepe meme. It channels the ruthless trading style of Wall Street legends, seeking to empower the WEPE Army of dedicated traders.

If you ain’t evolving, you dissolving! 🐸 pic.twitter.com/c4JdU4P1MY

— Wall Street Pepe (@WEPEToken) November 13, 2024

Wall Street Pepe is a project that puts a fresh spin on the beloved Pepe meme. It reimagines the iconic frog dressed in a sleek suit and weaves a story designed to engage meme coin fans.

The project emerges as a revolutionary meme coin project aimed at democratizing trading insights for crypto enthusiasts.

The WEPE token offers exclusive trading insights to its holders. Members also gain access to alpha calls and strategic information, which then helps traders make more informed investment and trade like pros.

The WEPE token also offers a passive income opportunity through its staking feature, which delivers a dazzling 68% annual percentage yield (APY).

You can buy WEPE tokens from the official website for $0.0003634 using ETH, USDT, or a bank card. Buy before a price hike in less than 4 days to lock in the best deal.

Purchase WEPE tokens here.

Related News:

Newest Meme Coin ICO – Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool – High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Chainlink

Chainlink  Sui

Sui  LEO Token

LEO Token  Stellar

Stellar  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  Wrapped stETH

Wrapped stETH  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Polkadot

Polkadot  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Dai

Dai  Aptos

Aptos  OKB

OKB  Gate

Gate  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Bittensor

Bittensor  Internet Computer

Internet Computer  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic  Cronos

Cronos  sUSDS

sUSDS

Comments are closed.