Key XRP Timelines to Watch That Could Spark a Major Market Move

- A popular crypto analyst has outlined some important events and timelines that could significantly impact the sentiment and the price of XRP.

- The analyst highlighted that the ProShares XRP ETF could be approved and go live on April 30.

XRP has recorded a 3% surge on its 24-hour price chart, “dragging” its price from $2.0 to $2.1 at press time. Within the period, the market experienced remarkable trading activities as volume increased by a staggering 68%, with $2.3 billion changing hands.

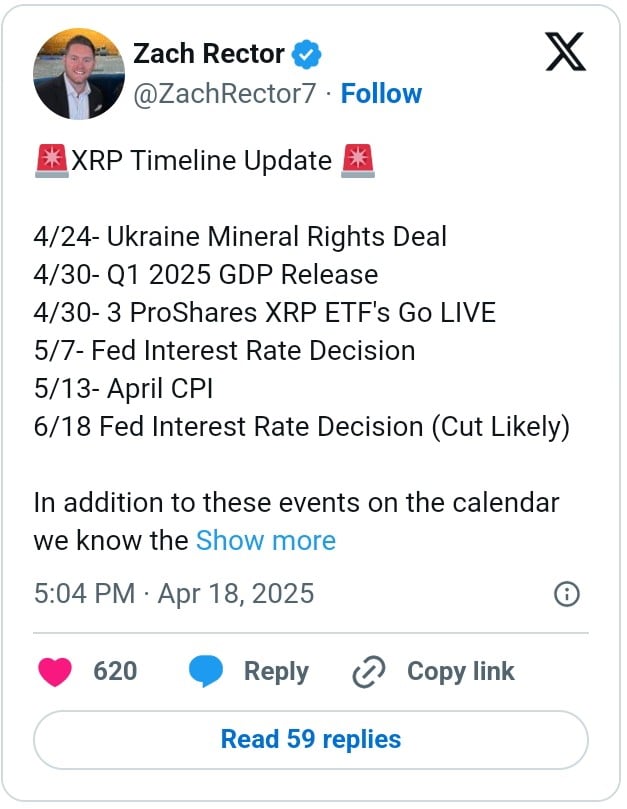

Amidst the backdrop of this, a Renowned analyst known as Zach Rector has identified and listed some key timelines that could cause a significant shift in market sentiment in the coming weeks. Speaking to his 75k X followers, Rector highlighted that April 24 could be a huge day for XRP as far as the Ukraine Mineral Right Deal is concerned.

Researching into this, CNF found that the underlying Washington and Kyiv deal could include oil and gas as both parties intend to “establish a reconstruction investment fund as part of an economic partnership”. Meanwhile, any international deal involving the US and countries affected by conflicts significantly affects the sentiment of risk assets like XRP.

More Timelines and Events that Could Impact XRP Price

Apart from this, Rector also advised XRP investors to keep an eye on April 30. Based on our research, the Bureau of Economic Analysis (BEA) will unveil an advanced estimate of the first quarter of 2025 (Q1 2025) Gross Domestic Product (GDP) growth on that day.

According to our analysts, stronger-than-expected GDP growth could boost confidence, increase purchasing power, and cause an interest rate hike in the broader sense. Either way, this would increase demand for Bitcoin and XRP as people go in for assets that could act as an inflationary hedge.

As discussed earlier, the ProShares XRP ETF could also go live on April 30, setting the price up for a bullish run. On top of this, Rector highlighted that a major interest rate decision could be made by the Federal Reserve on May 7, which could also impact the XRP price. Concluding his timeline updates, the analyst pointed out that May 13 could mark the release of the Consumer Price Index (CPI) while June 18 marks a major interest rate decision day.

As explained in our previous blog post, CPI usually provides an overview of the cost of living or inflation level within the country. A higher CPI usually shows rising inflation and demand for risk assets like Bitcoin and XRP. Apart from these key timelines, Rector also believes that investors should keep their tabs on other events, including the official end of the Ripple vs US Securities and Exchange Commission (SEC) case. Additionally, he hinted that US President Donald Trump could sign more trade deals.

With all of these acting as important catalysts, XRP is expected to react by surging to $15. According to our recent analysis, the XRP ETFs alone could attract a minimum inflow of $4 billion in their first year of trading, driving the market cap to around $925 billion.

Recommended for you:

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Sui

Sui  USDS

USDS  Hedera

Hedera  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Polkadot

Polkadot  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  WETH

WETH  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Aptos

Aptos  Dai

Dai  OKB

OKB  Gate

Gate  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Bittensor

Bittensor  Tokenize Xchange

Tokenize Xchange  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  Cronos

Cronos