BlackRock CEO’s Bullish Bitcoin Prediction Gains Traction as BTC Eyes $88.8K

- BlackRock CEO has disclosed that the recent decline of the Bitcoin (BTC) price presents a “rare buying opportunity for investors”.

- An on-chain analyst has hinted that Bitcoin is in the process of a bullish formation rather than a transition from bullish to a distribution phase.

Bitcoin (BTC) has staged a bullish reversal from $75k to $82k soon after US President Donald Trump announced a 90-day pause on all sweeping tariffs excluding China. According to our market data, Bitcoin surged by 12% on April 9, overturning losses on two crucial time-frames – daily and monthly trading sessions. As previously mentioned in our report, major altcoins, including XRP and Solana (SOL), followed with 8% and 6% gains.

This unexpected upsurge follows a recent remark by BlackRock CEO Larry Fink at the Economic Club of New York, highlighting that mass tariffs usually trigger a 20% correction, presenting a better opportunity to buy. Also, he pointed out that inflation appears higher than expected, forcing many to anticipate a recession for the US. Prior to this, Fink had issued a letter to shareholders, warning them that the US dollar could lose its strength once Americans find Bitcoin to be a safer haven.

Trump’s recent reciprocal tariffs had a grievous impact on the broad market with Jim Cramer accurately predicting “the immediate black Monday”. As discussed earlier, Cramer cautioned that the market could plunge into a sell-off as worse as the one encountered in 1987 if the situation is not salvaged. In this case, he advised that Trump engage the countries “that play by the rules” to prevent a more devastating meltdown.

On-chain analysts have also disclosed that price movements may not be over yet as deposits on Binance rise from 2,419,603 BTC to 2,435,662 BTC between March 28 and April 10. This represents a 16,059 BTC ($1,340,926,500) deposit increment in the past two weeks.

Historically, this precedes a significant nosedive as it signifies anxiety and negative reactions towards news signals. Amidst the backdrop of this, institutional investors’ acquisition of Bitcoin reached a significant level in the first quarter of the year, triggered by multiple factors, as outlined in our recent blog post.

Bitcoin Technical Analysis

According to technical analysis, the Keltner channel’s upper limit shows that the next crucial resistance level is around $88k. However, the channel’s lower limit indicates that a fall below the $80k level could see Bitcoin finding support at $73k.

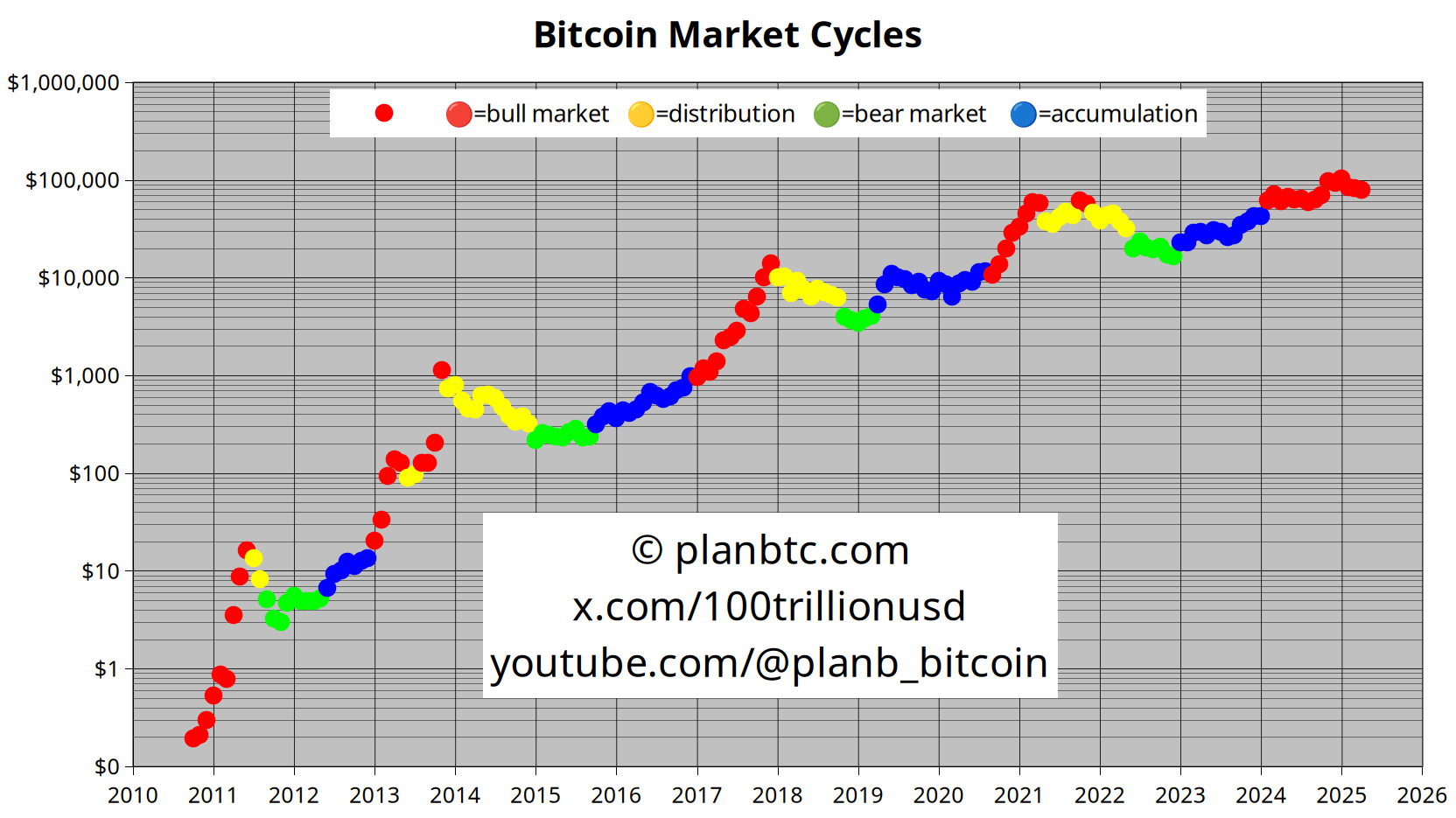

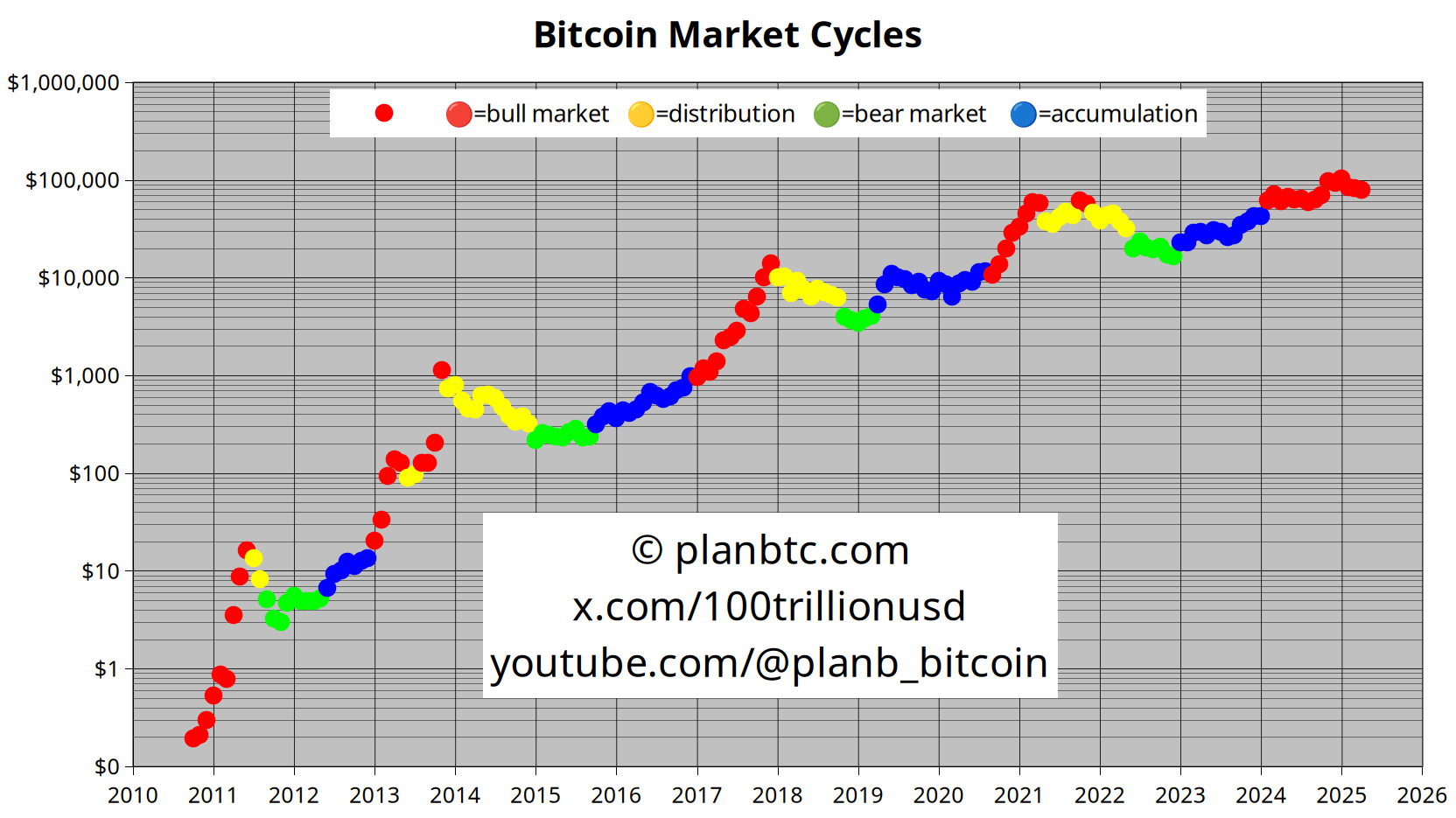

Joining the Bitcoin discussion, an analyst identified as PlanB has disclosed that his on-chain indicator signals a bull market. Also, the ongoing movement aligns with the normal behaviour of a bull market dip instead of a transition to a distribution phase.

Supporting his thesis with a chart, the analyst hinted that the bull market could still be forming as the 200-week arithmetic and the 200-week geometric are closing in on each other.

One more thing on those two lines. Notice that you can’t have a bear market or a big crash when the 200-week [arithmetic mean]and the geometric mean are together. The big crashes here [in 2021 and 2022]are happening when there’s a diversion between the two lines. Also, here in 2018, there was a big gap between the two [means]. Same here in 2014 and 2015.

Recommended for you:

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Sui

Sui  Wrapped stETH

Wrapped stETH  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  WETH

WETH  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Dai

Dai  OKB

OKB  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Aptos

Aptos  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Mantle

Mantle  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic