JPMorgan, Goldman Sachs Hike Recession Odds, Stocks Crash

Join Our Telegram channel to stay up to date on breaking news coverage

JPMorgan and Goldman Sachs have raised the odds of a recession in the US, the former citing Donald Trump’s “extreme” policies as the crypto and stock market crash.

The capitalization of the digital asset market plummeted over 3% in the last 24 hours, with Bitcoin briefly tumbling below $80K.

Meanwhile, the US stock market shed more than $1.7 trillion in value after President Donald Trump declined to rule out the possibility of a recession this year.

JPMorgan Raises Recession Odds To 40%

As Trump keeps the possibility of a recession this year open, economists at JPMorgan have increased the odds of a recession to 40%, from 30% previously.

“We see a material risk that the US falls into recession this year owing to extreme US policies,” the analysts said.

Goldman Sachs analysts are also bearish, raising their probability of a recession in the next 12 months to 20% from 15% previously.

The analysts warned that the odds of a recession will likely continue unless Trump changes course.

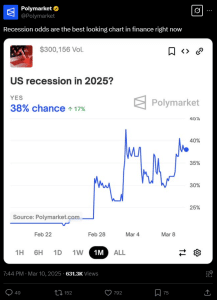

Users of the decentralized betting platform Polymarket also raised the chances of a recession in 2025. In the last month, odds for a contract on the platform have risen 18% to 38%.

Crypto Fear And Greed Index Signals ”Extreme Fear”

Crypto investor sentiment remains fearful. The Crypto Fear and Greed Index currently stands at 24, signaling “Extreme Fear.” This marks a 4-point increase in the last 24 hours. However, the index is still down 21 points compared to a month ago.

Meanwhile, Trump economic adviser Kevin Hassett said in a March 10 interview with CNBC that there are “a lot of reasons to be extremely bullish about the economy going forward.”

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Pi Network

Pi Network  LEO Token

LEO Token  USDS

USDS  Hedera

Hedera  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Sui

Sui  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  MANTRA

MANTRA  Polkadot

Polkadot  Ethena USDe

Ethena USDe  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Hyperliquid

Hyperliquid  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Monero

Monero  Lombard Staked BTC

Lombard Staked BTC  Uniswap

Uniswap  sUSDS

sUSDS  Dai

Dai  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Aave

Aave  Internet Computer

Internet Computer  Ondo

Ondo  Pepe

Pepe  OKB

OKB  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Mantle

Mantle  Gate

Gate