Top Crypto to Invest in Right Now October 27 – ORDI, Litecoin, Hedera

Join Our Telegram channel to stay up to date on breaking news coverage

Ripple CEO Brad Garlinghouse is optimistic about the future of cryptocurrency in the U.S., regardless of upcoming election results. He views the current regulatory challenges as a temporary “speed bump” and believes skeptics are overlooking the industry’s growth potential. Garlinghouse also noted that, despite political tensions, both major U.S. political parties have shown a growing openness to digital assets and blockchain technology.

This growing openness could lead to clearer, more supportive regulations soon, bringing stability to the market. In response, investors are closely watching for promising tokens, hoping to identify those with the potential for strong returns as the regulatory landscape evolves. This analysis reviews the top crypto to invest in right now based on their technological promise, use cases, and market positioning.

Top Crypto to Invest in Right Now

Theta Labs has announced that Hankuk University of Foreign Studies (HUFS) is now using its EdgeCloud AI services to enhance its role in the academic sector. Meanwhile, ORDI is trading at $32.48, reflecting a 5.03% gain in the past day. In addition, Hedera has integrated LayerZero into its network and launched its mainnet version 0.54, which aims to improve its functionality and interoperability.

1. ORDI (ORDI)

Last year, ORDI made history as the first BRC-20 token to surpass $1 billion in market capitalization. This milestone highlighted its role in decentralized finance (DeFi). It brought attention to the unique capabilities of the Ordinals protocol, which allows data to be embedded in Bitcoin’s smallest unit, the satoshi.

This feature expands Bitcoin’s use beyond basic transactions, sparking interest within the DeFi community. Moreover, ORDI is priced at $32.48, reflecting a 5.03% gain over the past day. The token’s market cap stands at around $681.99 million, and it shares this value with its fully diluted valuation (FDV), indicating that all tokens are already circulating.

Its volume-to-market cap ratio, at 7.83%, shows moderate daily trading interest relative to the overall market cap. Furthermore, ORDI’s price is positioned well above its 200-day simple moving average (SMA) of $13.55 by about 140.89%. This generally indicates a strong long-term trend, as trading above the SMA often signals positive price momentum.

The 14-day Relative Strength Index (RSI) is at 59.59, indicating a balanced position that does not suggest extreme buying or selling pressures. Price prediction, according to Coincodex, suggests ORDI could rise by 227.76% to reach around $105.09 by November.

2. Flockerz (FLOCK)

Flockerz is gaining momentum in the crypto market, recently surpassing $1 million in presale funding. This achievement indicates a growing interest in presales as a way for investors to diversify into smaller market cap projects that often focus on niche communities or distinct goals.

🥂We’re toasting to $1M! 🥂

Along with this mega milestone comes BIG news.

🔥TELEGRAM OPENS IN 3 DAYS!🔥

⌛October 26th at 15:00 CET. https://t.co/4cM18DEytN⌛ pic.twitter.com/o5vz6Nkfrb

— Flockerz (@FlockerzToken) October 23, 2024

In the meme coin sector, Flockerz stands out by integrating decentralized governance with community-driven incentives. Its “vote-to-earn” mechanism is central to this approach, allowing token holders to participate in project decisions while earning rewards. This setup aims to increase engagement and foster a democratic environment, giving the community a direct role in shaping the project.

The tokenomics of Flockerz includes a total supply of 12 billion tokens, with 2.4 billion available for presale at an initial price of $0.0058628 per token. The presale price will gradually increase, incentivizing early participation. The project allocates another 20% of its token supply to marketing, intended to boost visibility and facilitate exchange listings. A 10% allocation supports liquidity on exchanges, while 25% is designated for the DAO treasury to fund development.

One of Flockerz’s distinguishing features is its adherence to a clear roadmap, aiming to build sustainable value over time. By prioritizing governance and aligning incentives, the project appeals to investors interested in long-term potential rather than immediate gains. With plans to secure listings on centralized and decentralized exchanges, early investors in FLOCK can access presale prices before broader market availability.

Visit Flockerz Presale

3. Litecoin (LTC)

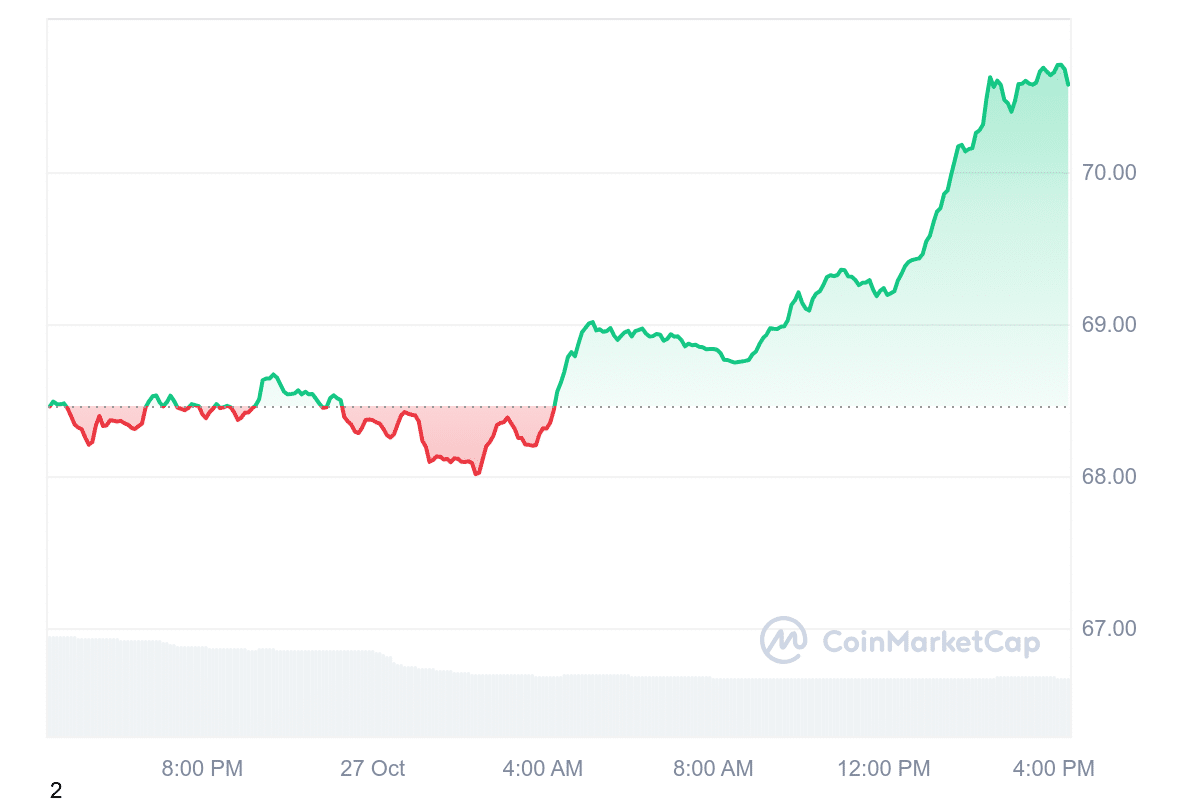

Litecoin has recently gained attention due to notable growth over the past week, hitting its highest trading volume since May 2023. This recent surge in activity reflects an uptick in market interest, with on-chain data indicating a “pump” in the Litecoin network, often interpreted as a bullish signal. However, it’s important to approach such short-term metrics with caution, as they don’t guarantee sustained momentum.

At press time, Litecoin is exchanging hands at $70.58, reflecting a daily increase of 3.09%. Its market capitalization is approximately $5.3 billion, while its volume-to-market cap ratio stands at 3.75%. Additionally, Litecoin has shown price growth in 15 out of the last 30 days, indicating a generally positive performance in the short term.

‘Litecoin ETF Approval ‘Very Soon’, Charlie Lee expressed confidence in the upcoming approval of a #Litecoin ETF following Canary Capital’s recent $LTC ETF application.’ – @ETHNews_comhttps://t.co/eIqToyq1dW

— Litecoin (@litecoin) October 24, 2024

Community sentiment around Litecoin is largely neutral, while the Fear & Greed Index currently indicates a level of 69, leaning toward “Greed.” Meanwhile, Litecoin’s founder, Charlie Lee, recently expressed optimism regarding the potential approval of a Litecoin Exchange-Traded Fund (ETF) following Canary Capital’s ETF application for LTC.

Interest in crypto ETFs has been growing, particularly following recent approvals of Bitcoin and Ether ETFs by the U.S. SEC. Lee’s optimism aligns with this trend of regulatory acceptance, which could further legitimize Litecoin and make it accessible to a broader range of investors.

4. Hedera (HBAR)

Hedera recently integrated LayerZero into its network, along with the release of its mainnet v0.54 update. This integration aims to enhance the Hedera Token Service (HTS), which enables the creation and management of both fungible and non-fungible tokens (NFTs). The update focuses on making transactions faster and more cost-effective.

The integration aligns with the HBAR Foundation’s goal of developing Hedera as a network suited for enterprise-level decentralized finance (DeFi). By adding LayerZero, Hedera becomes connected to more liquidity sources, particularly those from Ethereum-compatible platforms. This connection may broaden Hedera’s DeFi ecosystem, potentially attracting more institutional interest.

🛠️ The #Hedera mainnet has successfully been upgraded to v0.54, bringing with it the full implementation of Frictionless Airdrops’ core features as well as the ability for users to update token custom fee schedules via #SmartContract.

Learn more ➡️ https://t.co/7ScaZ9fxBL pic.twitter.com/zqPh39YXJP

— Hedera (@hedera) October 24, 2024

In addition, Prove AI AG, known for its AI governance solutions, recently launched a new AI product on Hedera’s blockchain. This platform helps businesses manage AI training data securely, aiming to meet compliance standards using Hedera’s infrastructure. Through this launch, Prove AI provides governance solutions for businesses working with AI, helping them navigate evolving regulatory requirements.

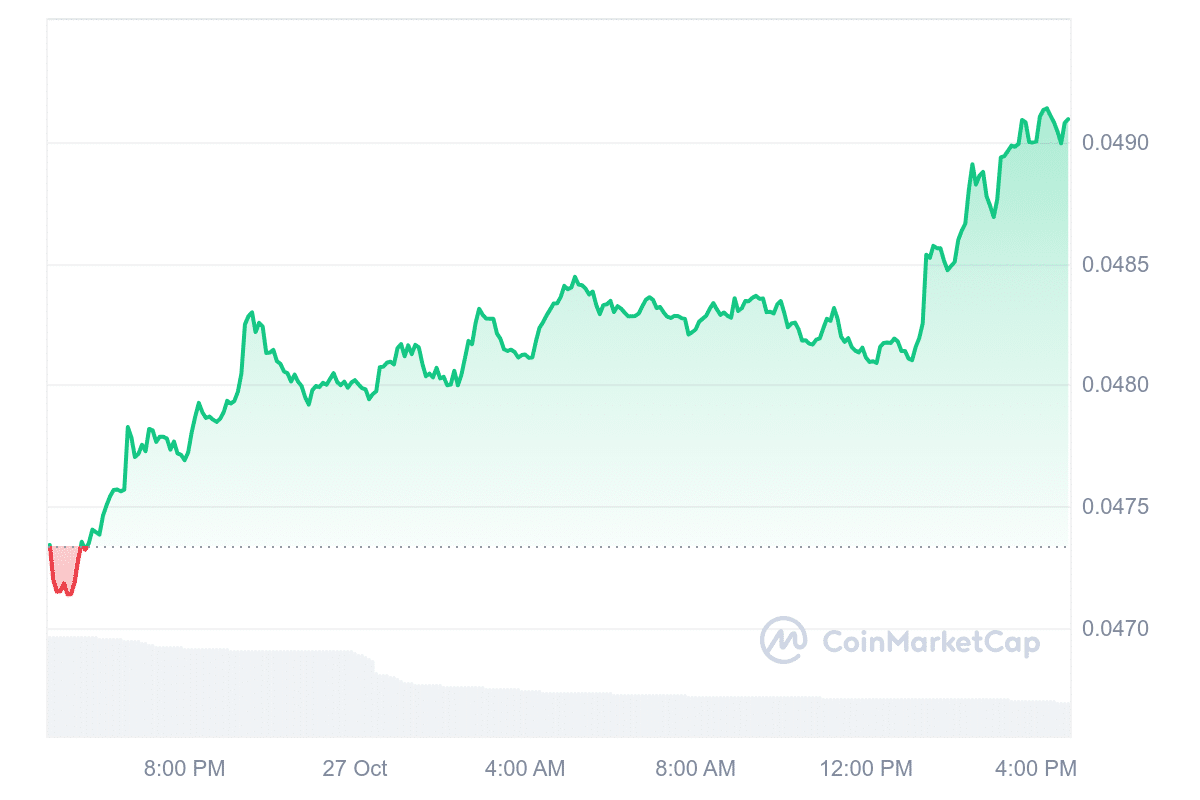

These developments have impacted the HBAR token’s market activity. Currently valued at $0.0491, HBAR has seen a 3.58% rise in intraday trading. It has also established support around the $0.04 mark, with recent gains reflecting the market’s interest in Hedera’s strategic moves in interoperability and AI governance.

5. Theta Network (THETA)

Theta Labs announced that Hankuk University of Foreign Studies (HUFS) has become its latest customer for EdgeCloud AI services. This partnership is part of Theta’s growing footprint in the academic sector in South Korea, where institutions such as Korea University, Seoul Women’s University, KAIST, and Yonsei University have also adopted Theta’s infrastructure to enhance their AI research capabilities.

The addition of HUFS signifies Theta Labs’ commitment to expanding its influence in the education sector, leveraging its technology to support advanced research in various innovative fields. In a significant move, Theta Labs has also attracted its first corporate client, Jamcoding, a leading platform in coding e-learning.

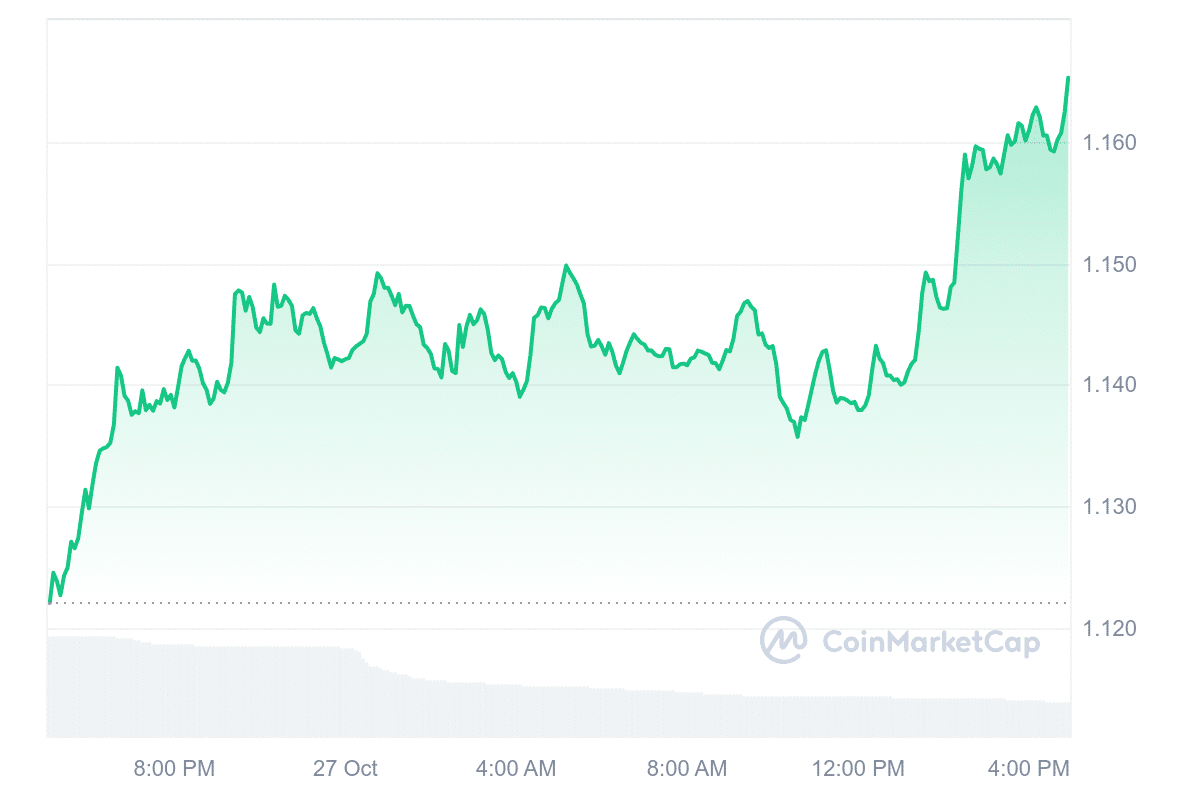

Meanwhile, Theta’s token has experienced a notable increase of 3.85%, now trading at $1.17. This upward movement places the token above its 200-day simple moving average. This price action suggests an improving market sentiment surrounding the token.

Theta expands its Korean academia presence with the addition of Hankuk University as the latest EdgeCloud AI customer:https://t.co/JTnstVM8IN pic.twitter.com/hVefK6OCDH

— Theta Network (@Theta_Network) October 21, 2024

In addition to the price increase, the token’s liquidity remains strong, supported by a solid market capitalization. The 14-day Relative Strength Index (RSI) is at 58.16, indicating a neutral market status—neither overbought nor oversold.

These developments represent a significant step in Theta Labs’ strategic objectives, enhancing its market position and expanding its application in various sectors. As partnerships grow and market performance remains stable, Theta Labs appears poised for continued engagement in academia and industry.

Read More

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards – pepeunchained.com

- $10+ Million Raised at ICO – Ends Soon

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  USDS

USDS  Internet Computer

Internet Computer  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Celestia

Celestia  Arbitrum

Arbitrum  MANTRA

MANTRA  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB

Comments are closed.