5 Best Altcoins To Watch Today December 14 – Kaia, XRP, Monero, Core

Join Our Telegram channel to stay up to date on breaking news coverage

As of December 14, 2024, the cryptocurrency market is experiencing a notable shift, with altcoins leading. While Bitcoin maintains a solid position, the data shows a clear trend of altcoins gaining momentum. However, the current shift has not yet reached the intensity of past altcoin seasons, where their performance significantly overshadowed Bitcoin.

This evolving market dynamic highlights the increasing influence of altcoins in the broader crypto landscape. In light of the positive crypto market wave, this article outlined other affordable tokens, particularly the best altcoins to watch today.

5 Best Altcoins To Watch Today

Kaia has experienced significant upward momentum recently, driven by growing investor interest and robust liquidity. Meanwhile, Pepe Unchained launched successfully on Uniswap and Dextools on December 10th. XRP is valued at 2.43, showing a 2.81% increase over the past 24 hours.

Monero (XMR) recorded a modest gain of 2.42% within the same timeframe. Core (CORE) stands at 1.4159, reflecting a daily growth of 3.11%. Pro-crypto Congressman French Hill has also been selected to chair the Financial Services Committee.

1. Kaia (KAIA)

Kaia has shown strong upward momentum recently, supported by increased investor activity and high liquidity. The current price is $0.2938, reflecting a 6.82% increase in the last 24 hours. Kaia’s market cap and fully diluted valuation stand at 1.73 billion, placing it among mid-to-large-cap cryptocurrencies.

The 24-hour trading volume surged by 120.32% to 142.6 million, signaling a significant increase in interest and participation. With a volume-to-market cap ratio of 8.13%, Kaia displays ample liquidity. This reduces the risk of slippage during trades and enhances market efficiency.

Sentiment indicators reflect strong optimism. The Fear & Greed Index registers 83, indicating extreme greed in the market. This highlights investor confidence but also suggests potential overbuying conditions. Over the past month, 70% of days—21 out of 30—have closed with gains. This points to consistent upward momentum and sustained buying pressure.

Kaia’s price trend remains positive. The price recently peaked above 0.31 before a slight pullback. It is now consolidating around 0.29. This stabilization, combined with the sharp increase in trading volume, suggests strong investor engagement.

📲 Introducing the Mini Dapp Launch Day Line Up

Exclusively powered by Kaia, the Dapp Portal (@dapp_portal) is your gateway to Mini Dapps, connecting millions of users across Asia through LINE Messenger.

🌟 We are starting strong with 20 handpicked Mini Dapps in the first wave,… pic.twitter.com/UMmTgiMFd2

— Kaia (prev. Klaytn & Finschia) (@KaiaChain) December 12, 2024

Key price levels to watch include support near 0.27 and resistance around 0.31. A clear breakout above resistance could signal further gains. However, failure to maintain support might lead to a short-term correction.

Kaia’s strengths are evident. Its high liquidity, consistent performance, and solid market position enhance investor confidence. The strong Fear & Greed reading further reflects this sentiment. Additionally, ranking #72 positions Kaia as an established asset within the crypto market.

2. Pepe Unchained ($PEPU)

Pepe Unchained made a strong debut on Uniswap and Dextools on December 10th. This followed an impressive presale, where the project raised nearly 74 million. Within the first 24 hours, the token demonstrated significant market activity. It recorded gains of 130% and attracted considerable attention from the crypto community.

The launch saw over 25,000 users claiming their tokens almost immediately. Trading began with a sharp surge of nearly 200%, pushing the price to a high of 0.05138. The token initially launched at around 0.01310, showing rapid growth as trading volumes increased. As a result, the market cap climbed to approximately 370 million.

Multiple exchanges lined up over the next few weeks. 🐸

Get ready for low-fee trading across key regions worldwide.

The journey has just begun. pic.twitter.com/rWIK3raoe4

— Pepe Unchained (@pepe_unchained) December 14, 2024

During this time, Pepe Unchained’s trading volume exceeded 37 million. This performance was particularly notable as most other meme coins were in decline. The overall meme coin market had lost more than 20 billion. Despite these unfavorable conditions, Pepe Unchained managed to stand out. This suggests strong investor confidence and growing interest in the project.

What sets Pepe Unchained apart is its use of Layer 2 technology, making it the first meme coin to do so. This infrastructure offers faster transactions and significantly lower fees. It aims to solve common issues in the meme coin market, such as slow processing times and high costs.

Pepe Unchained also operates on its dedicated blockchain, the Pepe Chain. This unique feature lays the groundwork for future meme coin launches. Pepe’s Pump Pad is central to this ecosystem, a tool allowing users to create and launch their meme coins. The process is simple and does not require any coding skills. This platform could attract new projects and drive adoption by enabling easy token creation.

Visit Pepe Unchained Presale

3. XRP (XRP)

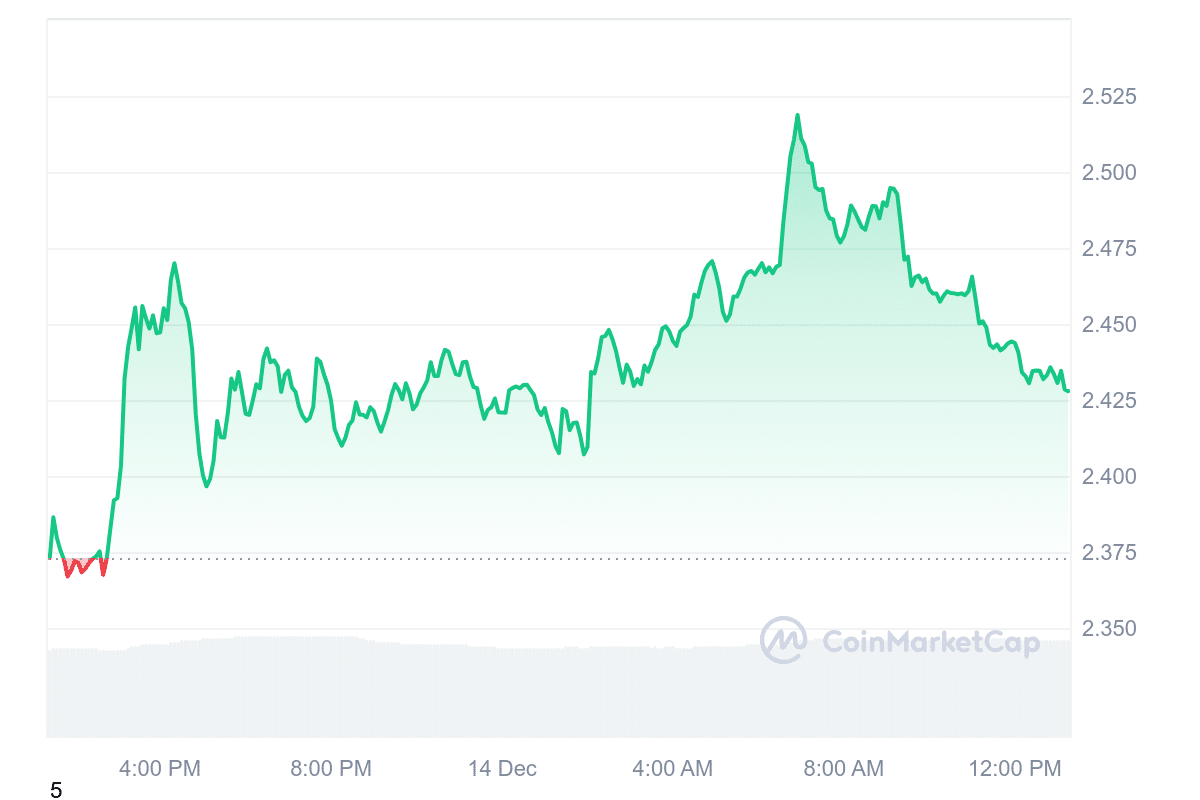

XRP is priced at 2.43, with a 24-hour price increase of 2.81%. Its market cap stands at 138.84B, reflecting a 3.57% rise. The fully diluted valuation (FDV) reached 242.75B, while the 24-hour trading volume climbed to 10.18 B. This marks an 11.94% increase in trading activity. The volume-to-market cap ratio sits at 7.33%, indicating strong liquidity. XRP has a circulating supply of 99.98B and a maximum supply capped at 100 B.

XRP’s price action began with a slight dip but soon reversed. It rose above 2.50, hitting its intraday high. After peaking, it retraced slightly and stabilized around 2.43. This suggests solid support at the current level.

Trading volume increased nearly 12%, reflecting growing investor interest and higher market activity. The combination of steady volume growth and price consolidation indicates cautious optimism.

Crypto custody is a lot more than just “not your keys, not your coins.”

Jas Takhar returns to #CryptoInOneMinute to explain the broader role of custody in securing and managing digital assets.

60 seconds—GO! ⏱️ pic.twitter.com/gOGUgpYyHH

— Ripple (@Ripple) December 13, 2024

XRP’s 138.84B market cap keeps it among the top crypto assets. Additionally, its volume-to-market cap ratio of 7.33% highlights healthy liquidity. XRP’s supply structure is transparent, with a maximum supply of 100B, which adds stability for investors. The recent upward price movement and increased trading volume indicate positive market momentum.

4. Monero (XMR)

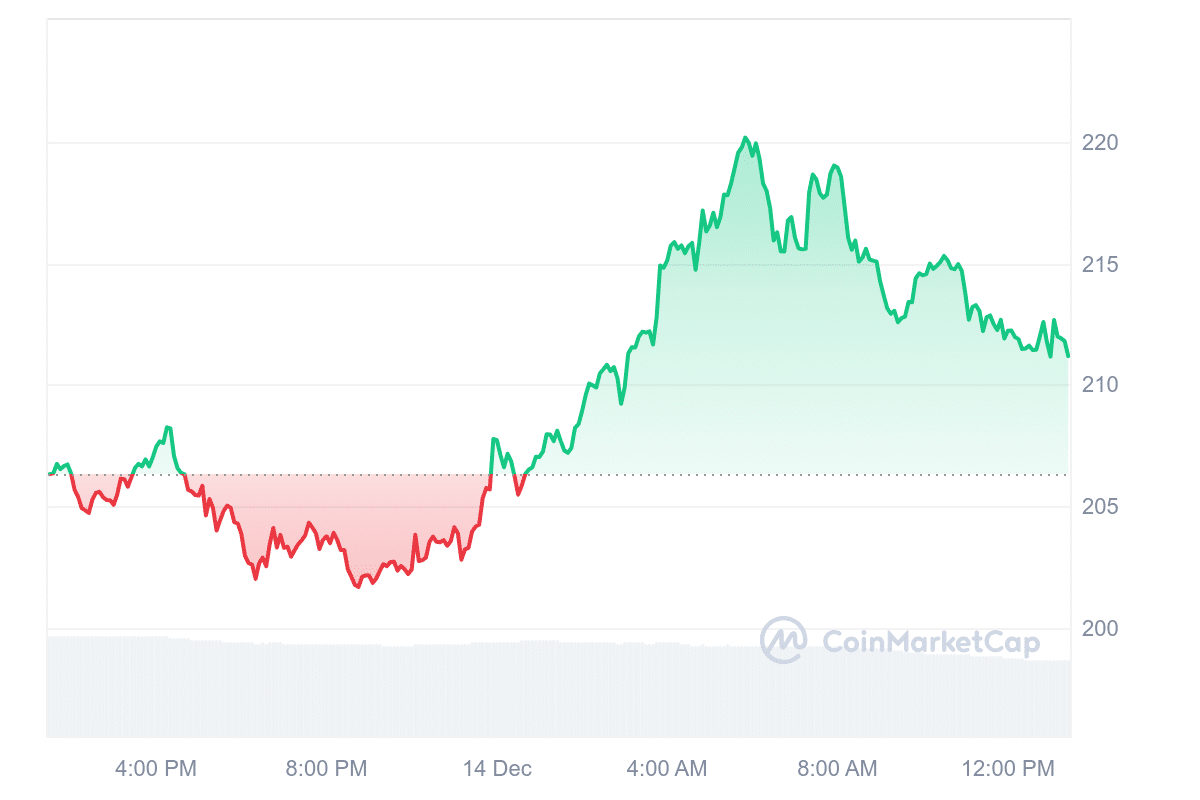

Monero (XMR) has shown a moderate increase, gaining 2.42% over the past 24 hours. The current price is $211.18, while its market capitalization has reached $3.89 billion. This growth aligns with broader positive trends in the cryptocurrency market.

The 24-hour trading volume rose 23.79% to $116.74 million, signaling increased investor activity. The volume-to-market cap ratio of 3.01% suggests a balanced level of liquidity and steady trading engagement.

Recent price movements reflect a recovery from a prior decline, with Monero maintaining upward momentum early in the day. Although minor pullbacks occurred, the price has held steady above $210, suggesting strong support and prevailing bullish sentiment.

Unboxing the Monero Nodo (a dedicted device for your Monero node) Founders Edition!

‘Nodo is committed to making Monero nodes more accessible, fostering decentralization, and contributing to the ongoing success of Monero.’ – by @MoneroNodo https://t.co/1Q0hUmguZw

— Monero (XMR) (@monero) December 13, 2024

Launched in 2014, Monero stands out as a privacy-focused cryptocurrency. It employs advanced cryptographic techniques to ensure transaction anonymity and untraceability, setting it apart from transparent networks like Bitcoin. This feature appeals to users seeking confidentiality in digital payments.

With a limited total supply of 18.44 million XMR, Monero’s scarcity adds to its perceived value. Its unique focus on privacy and consistent demand solidify its role as a key asset in the cryptocurrency landscape.

5. Core (CORE)

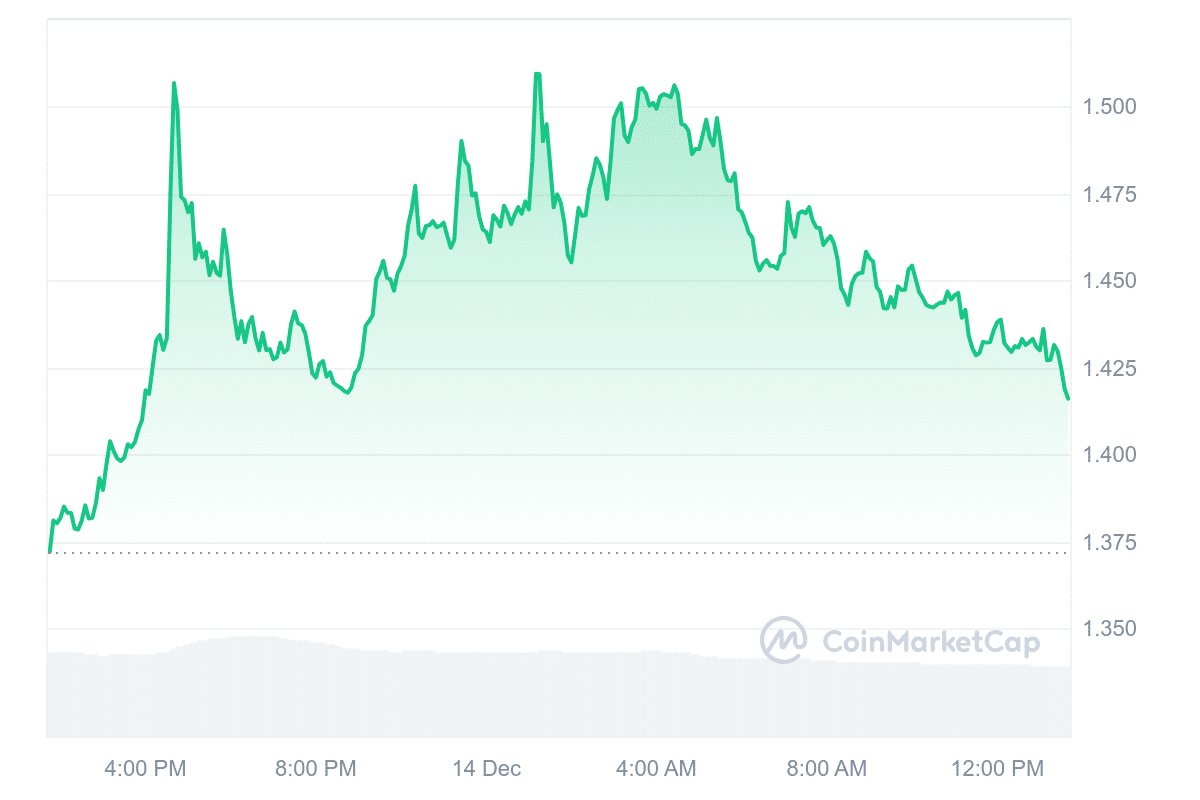

Core (CORE) is priced at 1.4159, reflecting a 3.11% daily increase. Over the past year, its value has grown by 148%, indicating steady long-term growth. The price is 101.37% above the 200-day Simple Moving Average (SMA) of 0.7031, demonstrating a clear upward trend. Additionally, CORE has outperformed 70% of the top 100 cryptocurrencies during the year and has shown relative strength against major assets like Bitcoin and Ethereum.

Liquidity remains high due to its market cap, which ensures smooth trading. CORE has recorded gains in 17 of the last 30 days, representing roughly 57%. This suggests steady momentum despite occasional volatility. The price has seen sharp spikes before retracing and is currently stabilizing around the 1.42 mark. Still, it stays well above key support levels like the 200-day SMA.

Bitcoin Fusion MENA was a blast! 🌍

Huge thanks to everyone who made Bitcoin Fusion one of the best events at @bitcoinmenaconf! 🔶🚀 pic.twitter.com/2mtfm2FkP9

— Core DAO 🔶 (@Coredao_Org) December 13, 2024

The Fear & Greed Index is now at 83, signaling “Extreme Greed.” This highlights strong investor confidence and buying enthusiasm. However, it also points to the need for caution. Extreme optimism often precedes potential corrections, so investors should monitor the market closely.

CORE has shown consistent performance, with strong liquidity and upward momentum. While the short-term price movement reflects volatility, the long-term trend remains positive.

Learn More

Newest Meme Coin ICO – Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool – High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Stellar

Stellar  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Uniswap

Uniswap  LEO Token

LEO Token  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  Bittensor

Bittensor  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  Dai

Dai  Arbitrum

Arbitrum  Virtuals Protocol

Virtuals Protocol